CHS Inc. is incorporated in the state of Minnesota. The company is a cooperative energy company based on revenues and identifiable assets, with operations that include petroleum refining and pipelines; the supply, marketing (including ethanol and biodiesel) and distribution of refined fuels (gasoline, diesel fuel and other energy products); the blending, sale and distribution of lubricants; and the wholesale supply of propane. Its Energy segment processes crude oil into refined petroleum products at refineries in Laurel, Montana (wholly-owned) and McPherson, Kansas and sells those products under the Cenex brand to member cooperatives and others through a network of approximately 1,400 independent retail sites, of which 57% are convenience stores marketing Cenex branded fuels. It makes approximately 72% of refined fuel sales to members, with the balance sold to non-members. Sales are made wholesale to member cooperatives and through a network of independent retailers that operate convenience stores under the Cenex tradename. The company's Ag Business segment includes crop nutrients, country operations, grain marketing and oilseed processing. Its revenues in Ag Business segment primarily include grain sales....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 28 June 2025

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework rev

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2020-07-19 09:25:00 Sunday ET

Senior business leaders can learn much from the lean production system with iterative continuous improvements at Toyota. Takehiko Harada (2015)

2024-10-27 07:56:01 Sunday ET

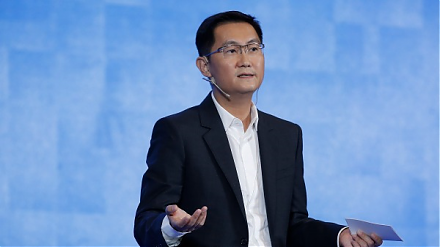

Stock Synopsis: China Internet tech titans continue to grow amid greater competition. We launch our unique coverage of top 25 China Internet stocks. In t

2023-06-14 10:26:00 Wednesday ET

Daron Acemoglu and James Robinson show that good inclusive institutions contribute to better long-run economic growth. Daron Acemoglu and James Robinson

2019-02-06 10:36:49 Wednesday ET

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President