Cellular Biomedicine Group Inc. is a biomedicine firm engaged in the development of new treatments for degenerative and cancerous diseases utilizing proprietary cell therapy technologies. The Company offers developmental stem cell, progenitor cell, and immune cell projects. It is developing treatments utilizing proprietary cell technologies for the treatment of a range of cancers; joint disease and central nervous system diseases. Cellular Biomedicine Group Inc. is headquartered in Palo Alto, California....

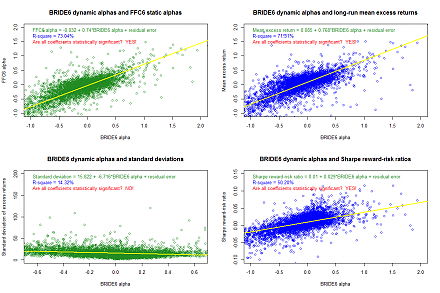

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-03-21 11:28:00 Tuesday ET

Barry Eichengreen compares the Great Depression of the 1930s and the Great Recession as historical episodes of economic woes. Barry Eichengreen (2016)

2018-01-07 09:33:00 Sunday ET

Zuckerberg announces his major changes in Facebook's newsfeed algorithm and user authentication. Facebook now has to change the newsfeed filter to prior

2018-07-05 13:40:00 Thursday ET

U.S. trading partners such as the European Union, Canada, China, Japan, Mexico, and Russia voice their concern at the World Trade Organization (WTO) in ligh

2023-01-11 09:26:00 Wednesday ET

Addendum on USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S

2018-08-05 12:34:00 Sunday ET

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yie

2019-11-17 14:43:00 Sunday ET

New computer algorithms and passive mutual fund managers run the stock market. Morningstar suggests that the total dollar amount of passive equity assets re