CarGurus, Inc. is an online automotive marketplace connecting buyers and sellers of new and used cars. The company uses proprietary technology, search algorithms and data analytics. It operates primarily in Canada, the United Kingdom and Germany. CarGurus, Inc.is based in CAMBRIDGE, United States....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-02-09 08:33:00 Saturday ET

Apple provides positive forward guidance on both revenue and profit forecasts for iPhones, iPads, and MacBooks. In the Christmas 2018 festive season, MacBoo

2019-08-24 14:38:00 Saturday ET

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2018-03-01 07:35:00 Thursday ET

Trump imposes high tariffs on steel (25%) and aluminum (10%) in a new trade war with subsequent exemptions for Canada and Mexico. The Trump administration&#

2023-12-05 09:25:00 Tuesday ET

Better corporate ownership governance through worldwide convergence toward Berle-Means stock ownership dispersion Abstract We design a model

2023-08-21 12:25:00 Monday ET

Steven Shavell presents his economic analysis of law in terms of the economic outcomes of both legal doctrines and institutions. Steven Shavell (2004)

2019-05-05 10:34:00 Sunday ET

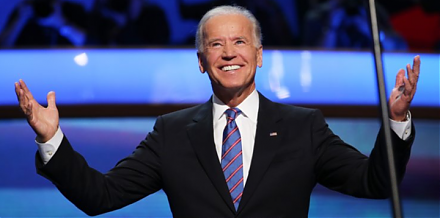

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands ou