Bankwell Financial Group, Inc. is a commercial bank which serves residents and businesses primarily in Fairfield and New Haven Counties, CT. It offers checking, savings, money market accounts; demand and NOW deposits, certificates of deposit, commercial lending products as well as electronic banking and online banking services. Bankwell Financial Group, Inc. is headquartered in New Canaan, Connecticut....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical

2025-02-02 11:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2025. Our proprietary alpha investment model outperforms the ma

2023-09-28 08:26:00 Thursday ET

Daron Acemoglu and James Robinson show a constant economic tussle between society and the state in the hot pursuit of liberty. Daron Acemoglu and James R

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu

2017-11-23 10:42:00 Thursday ET

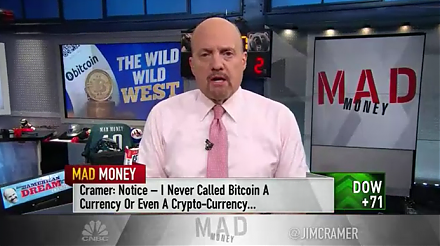

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2019-09-01 10:31:00 Sunday ET

Most artificial intelligence applications cannot figure out the intricate nuances of natural language and facial recognition. These intricate nuances repres