Bowlero Corp. is an owner and operator of bowling centers as well as owner of the Professional Bowlers Association. Bowlero Corp., formerly known as Isos Acquisition Corporation, is based in RICHMOND, Va....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-12-04 12:30:00 Monday ET

Bank leverage and capital bias adjustment through the macroeconomic cycle Abstract We assess the quantitative effects of the recent proposal

2017-01-03 03:26:00 Tuesday ET

President-Elect Donald Trump wants Apple and its tech peers to consider better and greater high-tech job creation in America. Apple has asked its primary

2025-09-21 12:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-12-23 13:39:00 Sunday ET

The House of Representatives considers a government expenditure bill with border wall finance and therefore sets up a shutdown stalemate with Senate. As fre

2019-04-17 11:34:00 Wednesday ET

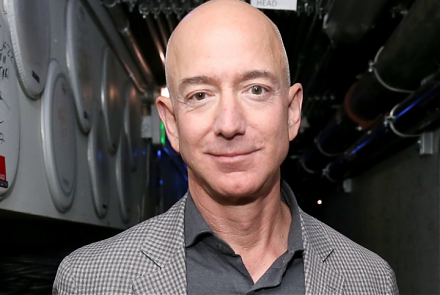

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2018-06-06 09:39:00 Wednesday ET

Donald Trump and Kim Jong Un meet, talk, and shake hands in the historic peace summit between America and North Korea in Singapore. At the start of the bila