Bank of the James Financial Group, Inc. operates as the holding company for Bank of the James, which provides retail and commercial banking services in the central Virginia. The company offers various deposit services, including checking accounts, savings accounts, individual retirement accounts, and various time deposits. It originates commercial business lending loans for purchase of equipment, facilities' upgrades, inventory acquisition, and working capital purposes; commercial and residential construction and development loans; commercial real estate mortgage loans; consumer residential mortgage loans; and various secured and unsecured consumer loans. The company's market area consists of seven jurisdictions of the Town of Altavista, Amherst County, Appomattox County, the City of Bedford, Bedford County, Campbell County, and the City of Lynchburg. The company, through its other subsidiary, BOTJ Investment Group, Inc., offers brokerage and investment services, including fixed and variable annuity products....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-12-30 11:28:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube December 2019 In this podcast, we discuss several topical issues as of December 2019: (1) The Trump adm

2017-05-13 07:28:00 Saturday ET

America's Top 5 tech firms, Apple, Alphabet, Microsoft, Amazon, and Facebook have become the most valuable publicly listed companies in the world. These

2017-08-13 09:36:00 Sunday ET

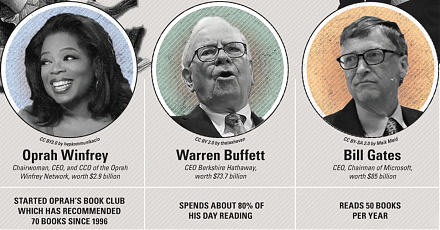

Several investors and billionaires such as George Soros, Warren Buffett, Carl Icahn, and Howard Marks suggest that the time may be ripe for a major financia

2019-03-05 10:40:00 Tuesday ET

We may need to reconsider the new rules of personal finance. First, renting a home can be a smart money move, whereas, buying a home cannot always be a good

2019-09-03 14:29:00 Tuesday ET

Due to U.S. tariffs and other cloudy causes of economic policy uncertainty, Apple, Nintendo, and Samsung start to consider making tech products in Vietnam i

2018-04-02 07:33:00 Monday ET

China President Xi JinPing tries to ease trade tension between America and China in his presidential address at the annual Boao forum. In his vulnerable att