Bristol-Myers Squibb is a one of the leading global specialty biopharmaceutical companies focused on the development of treatments targeting serious diseases like cancer, inflammatory, immunologic, cardiovascular or fibrotic diseases. Backed by its blockbuster immuno-oncology drug, Opdivo, Bristol-Myers has a strong oncology portfolio, comprising other drugs like Revlimid, Pomalyst, Sprycel, Yervoy and Empliciti. It also has important immunology and cardiovascular drugs like Orencia and Eliquis. It's experiencing growth in both the Eliquis brand and the market, while also advancing its Factor XIa inhibitor program. After the sale of the global Diabetes business to AstraZeneca and the discontinuation of discovery research efforts in virology, it's focusing solely on research in core therapeutic areas like oncology, immuno-oncology, immunoscience, cardiovascular, fibrosis and genetically defined diseases. It acquried Celgene Corporation and MyoKardia. It received regulatory approvals for Reblozyl and Inrebic....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-12-30 11:28:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube December 2019 In this podcast, we discuss several topical issues as of December 2019: (1) The Trump adm

2019-02-05 10:32:00 Tuesday ET

President Trump remains optimistic about the Sino-American trade war resolution of both trade deficit eradication and tech transfer enforcement. Trump now s

2016-11-08 00:00:00 Tuesday ET

Donald Trump defies the odds to become the new U.S. president. He wants to make America great again. He seeks to repeal Obamacare. He has zero tole

2018-08-23 11:34:00 Thursday ET

Harvard financial economist Alberto Cavallo empirically shows the recent *Amazon effect* that online retailers such as Amazon, Alibaba, and eBay etc use fas

2017-07-19 11:35:00 Wednesday ET

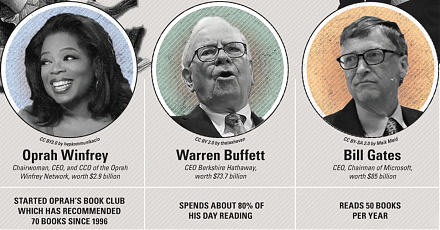

This brief article encapsulates the timeless wisdom of Warren Buffett's famous quotes on fundamental stock investment, fear and greed, patience, risk co

2026-04-30 08:28:00 Thursday ET

In the current global market for better biotech advances, medical innovations, and healthcare services, the new integration of artificial intelligence (AI)