Bristol-Myers Squibb is a one of the leading global specialty biopharmaceutical companies focused on the development of treatments targeting serious diseases like cancer, inflammatory, immunologic, cardiovascular or fibrotic diseases. Backed by its blockbuster immuno-oncology drug, Opdivo, Bristol-Myers has a strong oncology portfolio, comprising other drugs like Revlimid, Pomalyst, Sprycel, Yervoy and Empliciti. It also has important immunology and cardiovascular drugs like Orencia and Eliquis. It's experiencing growth in both the Eliquis brand and the market, while also advancing its Factor XIa inhibitor program. After the sale of the global Diabetes business to AstraZeneca and the discontinuation of discovery research efforts in virology, it's focusing solely on research in core therapeutic areas like oncology, immuno-oncology, immunoscience, cardiovascular, fibrosis and genetically defined diseases. It acquried Celgene Corporation and MyoKardia. It received regulatory approvals for Reblozyl and Inrebic....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-07 18:42:00 Monday ET

Neoliberal public choice continues to spin national taxation and several other forms of government intervention. The key post-crisis consensus focuses on go

2023-12-03 11:33:00 Sunday ET

Macro innovations and asset alphas show significant mutual causation. April 2023 This brief article draws from the recent research publicati

2018-04-26 07:37:00 Thursday ET

Credit supply growth drives business cycle fluctuations and often sows the seeds of their own subsequent destruction. The global financial crisis from 2008

2025-10-12 13:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-05-27 08:33:00 Sunday ET

The Federal Reserve proposes softening the Volcker rule that prevents banks from placing risky bets on securities with deposit finance. As part of the po

2017-03-03 05:39:00 Friday ET

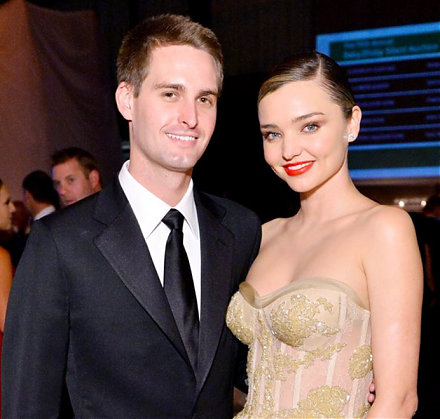

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.