BioMarin Pharmaceutical Inc. focuses on the development and commercialization of treatments for serious life-threatening medical conditions, mostly for children. The company's portfolio comprises seven marketed products namely, Aldurazyme, Naglazyme, Kuvan a rare genetic enzyme deficiency disorder), Vimizim , Brineura, Palynziq and Voxzogo. BioMarin has a collaboration agreement with Sanofi's subsidiary Genzyme for Aldurazyme. Genzyme is BioMarin's sole customer for Aldurazyme and is responsible for marketing and selling Aldurazyme to third parties.'The newest drug in BioMarin's portfolio, Voxzogo for treating achondroplasia, the most common form of dwarfism. BioMarin's biologics license application (BLA) for Roctavian/valoctocogene roxaparvovec (valrox), a gene therapy for severe hemophilia A, was given a complete response letter (CRL) by the FDA....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-08-14 10:31:00 Wednesday ET

Netflix suffers its first major loss of U.S. subscribers due to the recent price hikes. The company adds only 2.7 million new subscribers in 2019Q2 in stark

2019-03-03 10:39:00 Sunday ET

Tech companies seek to serve as quasi-financial intermediaries. Retail traders can list items for sale on eBay and then acquire these items economically on

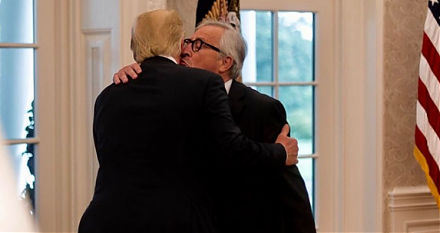

2018-07-23 07:41:00 Monday ET

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2019-07-11 10:48:00 Thursday ET

France and Germany are the biggest beneficiaries of Sino-U.S. trade escalation, whereas, Japan, South Korea, and Taiwan suffer from the current trade stando

2018-01-09 08:33:00 Tuesday ET

BlackRock CEO Larry Fink emphasizes his key conviction that public corporations should make a positive contribution to society apart from boosting the botto

2019-01-25 13:34:00 Friday ET

Netflix raises its prices by 13% to 18% for U.S. subscribers. The immediate stock market price soars 6.5% as a result of this upward price adjustment. The b