BSB Bancorp, Inc. (BSB Bancorp), incorporated on June 2, 2011, is a bank holding company of Belmont Savings Bank (the Bank). The Company's Belmont Savings Bank is a chartered savings bank. The Bank's business consists primarily of accepting deposits from the general public, small businesses and municipalities, and investing those deposits, together with funds generated from operations and borrowings, in one- to four-family residential mortgage loans, commercial real estate loans, multi-family real estate loans, home equity lines of credit, indirect automobile loans (automobile loans assigned to it by automobile dealerships), commercial business loans, construction loans and investment securities. The Bank also makes other consumer loans and second mortgage loans. The Bank offers a range of deposit accounts, including relationship checking accounts for consumers and businesses, passbook and statement savings accounts, certificates of deposit, money market accounts, Interest on Lawyer Trust Accounts (IOLTA), commercial, municipal and regular checking accounts, and Individual Retirement Accounts (IRAs). The Bank offers a range of commercial and retail banking services, which include cash management, online and mobile banking, and global payments and foreign exchange. The Bank conducts operations from over six full service branch offices located in Belmont, Watertown, Waltham, Newton and Cambridge in Southeast Middlesex County, Massachusetts. Its primary lending market includes Essex, Middlesex, Norfolk and Suffolk Counties, Massachusetts. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-05-14 12:31:00 Sunday ET

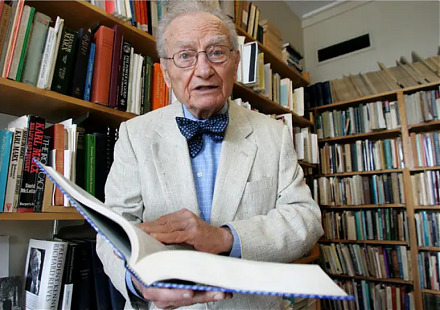

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2019-07-25 16:42:00 Thursday ET

Platforms benefit from positive network effects, scale economies, and information cascades. There are at least 2 major types of highly valuable platforms: i

2023-08-21 12:25:00 Monday ET

Steven Shavell presents his economic analysis of law in terms of the economic outcomes of both legal doctrines and institutions. Steven Shavell (2004)

2019-10-11 13:40:00 Friday ET

Apple CEO Tim Cook maintains a frugal low-key lifestyle. With $625 million public wealth, Cook leads the $1 trillion tech titan Apple in the post-Jobs era.

2020-05-07 08:26:00 Thursday ET

Disruptive innovators often apply their 5 major pragmatic skills in new blue-ocean niche discovery and market share dominance. Jeff Dyer, Hal Gregersen,

2018-12-09 08:44:00 Sunday ET

President Trump meets with Chinese President Xi again at the G20 summit in the city of Buenos Aires, Argentina, in late-November 2018. President Donald Trum