BSB Bancorp, Inc. (BSB Bancorp), incorporated on June 2, 2011, is a bank holding company of Belmont Savings Bank (the Bank). The Company's Belmont Savings Bank is a chartered savings bank. The Bank's business consists primarily of accepting deposits from the general public, small businesses and municipalities, and investing those deposits, together with funds generated from operations and borrowings, in one- to four-family residential mortgage loans, commercial real estate loans, multi-family real estate loans, home equity lines of credit, indirect automobile loans (automobile loans assigned to it by automobile dealerships), commercial business loans, construction loans and investment securities. The Bank also makes other consumer loans and second mortgage loans. The Bank offers a range of deposit accounts, including relationship checking accounts for consumers and businesses, passbook and statement savings accounts, certificates of deposit, money market accounts, Interest on Lawyer Trust Accounts (IOLTA), commercial, municipal and regular checking accounts, and Individual Retirement Accounts (IRAs). The Bank offers a range of commercial and retail banking services, which include cash management, online and mobile banking, and global payments and foreign exchange. The Bank conducts operations from over six full service branch offices located in Belmont, Watertown, Waltham, Newton and Cambridge in Southeast Middlesex County, Massachusetts. Its primary lending market includes Essex, Middlesex, Norfolk and Suffolk Counties, Massachusetts. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-25 13:34:00 Friday ET

Netflix raises its prices by 13% to 18% for U.S. subscribers. The immediate stock market price soars 6.5% as a result of this upward price adjustment. The b

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2017-12-01 06:30:00 Friday ET

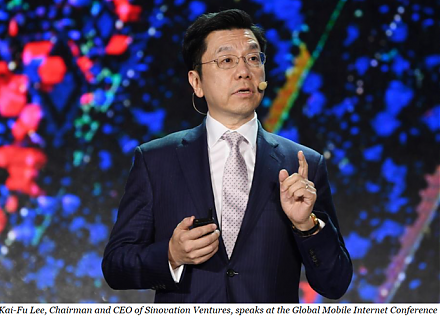

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2019-05-17 15:24:00 Friday ET

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments an

2018-11-30 12:42:00 Friday ET

Andy Yeh Alpha (AYA) AYA Analytica financial health memo (FHM) podcast channel on YouTube November 2018 AYA Analytica is our online regular podcast and news

2019-09-17 08:33:00 Tuesday ET

Global stock market investors foresee the harbinger of a major economic downturn. Many stock market investors become anxious due to negative term spreads an