Barnes & Noble, Inc., incorporated on November 19, 1986, is a bookseller. The Company is a content and commerce company, which provides access to trade books and other content across its multi-channel distribution platform. It operates in two segments: Barnes & Noble Retail (B&N Retail) and NOOK. The Company is engaged in the sale of trade books (generally hardcover and paperback consumer titles), mass market paperbacks (such as mystery, romance, science fiction and other fiction), children's books, eBooks and other digital content, textbooks and course-related materials, NOOK and related accessories, bargain books, magazines, gifts, cafe products and services, educational toys and games, music and movies direct to customers through its bookstores or on www.barnesandnoble.com. The Company also offers a textbook rental option to its customers through barnesandnoble.com. The Company offers its customers a suite of textbook options-new, used, digital and rental. As of April 30, 2016, the Company operates 640 bookstores in 50 states, maintains an e-commerce site, develops digital reading products and operates digital bookstores. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-07-07 10:33:00 Saturday ET

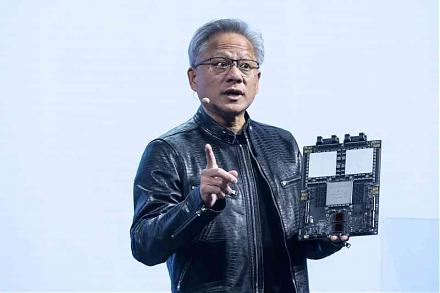

The east-west tech rivalry intensifies between BATs (Baidu, Alibaba, and Tencent) and FAANGs (Facebook, Apple, Amazon, Netflix, and Google). These Sino-U.S.

2025-09-24 09:49:53 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-09-27 11:41:00 Thursday ET

Michael Kors pays $2.3 billion to acquire the Italian elite fashion brand Versace. In accordance with Michael Kors's 5-year plan, the joint company grow

2023-11-14 08:24:00 Tuesday ET

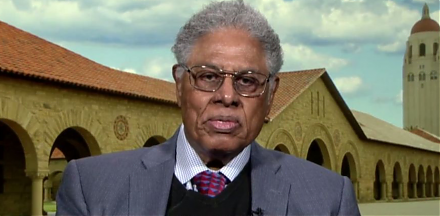

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2018-07-25 11:41:00 Wednesday ET

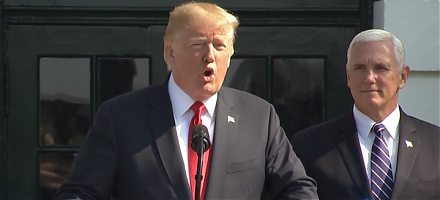

President Trump hails and touts America's new high real GDP economic growth in 2018Q2. The U.S. is now a $20+ trillion economy, and America hits this mi

2023-03-14 16:43:00 Tuesday ET

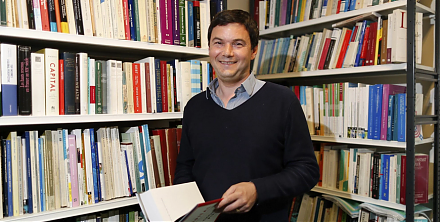

Several feasible near-term reforms can substantially narrow the scope for global tax avoidance by closing information loopholes. Thomas Pogge and Krishen