Black Knight, Inc. engages in the provision of integrated technology, workflow automation and data and analytics to the mortgage and real estate industries, through its subsidiaries. It operates through the Technology and Data and Analytics business segments. Technology segment offers software and hosting solutions which support loan servicing, loan origination and settlement services. Data and Analytics segment provides property ownership data, lien data, servicing data, automated valuation models, collateral risk scores, prepayment and default models, lead generation and other data solutions. Black Knight Inc., formerly known as Black Knight Financial Services Inc., is headquartered in Jacksonville, FL....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-03-03 05:39:00 Friday ET

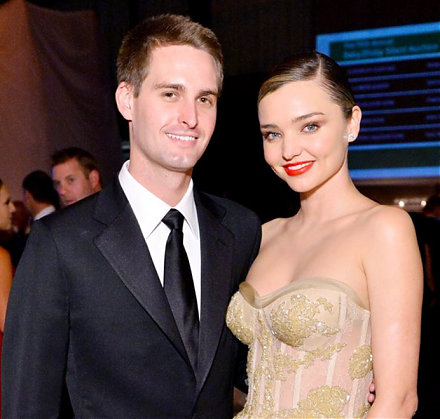

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2018-04-20 10:38:00 Friday ET

Allianz chairman Mohamed El-Erian bolsters a new American economic paradigm in lieu of the Washington consensus. The latter dominates the old school of thou

2019-07-01 12:35:00 Monday ET

Apple releases the new iOS 13 smartphone features. These features include Dark Mode, Audio Share, Memoji, better privacy protection, smart photo collection,

2024-10-14 11:33:00 Monday ET

Stock Synopsis: Video games continue to take both screen time and monetization from many other forms of entertainment. We are broadly positive about the

2017-08-25 13:36:00 Friday ET

The U.S. Treasury's June 2017 grand proposal for financial deregulation aims to remove several aspects of the Dodd-Frank Act 2010 such as annual macro s

2018-06-07 10:36:00 Thursday ET

AT&T wins court approval to take over Time Warner with a trademark $85 billion bid despite the Trump administration prior dissent due to antitrust conce