Black Knight, Inc. engages in the provision of integrated technology, workflow automation and data and analytics to the mortgage and real estate industries, through its subsidiaries. It operates through the Technology and Data and Analytics business segments. Technology segment offers software and hosting solutions which support loan servicing, loan origination and settlement services. Data and Analytics segment provides property ownership data, lien data, servicing data, automated valuation models, collateral risk scores, prepayment and default models, lead generation and other data solutions. Black Knight Inc., formerly known as Black Knight Financial Services Inc., is headquartered in Jacksonville, FL....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-09-30 07:33:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube September 2019 In this podcast, we discuss several topical issues as of September 2019: (1) Former

2018-09-30 14:34:00 Sunday ET

Goldman, JPMorgan, Bank of America, Credit Suisse, Morgan Stanley, and UBS face an antitrust lawsuit. In this lawsuit, a U.S. judge alleges the illegal cons

2018-09-13 19:38:00 Thursday ET

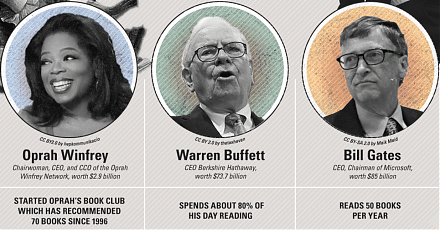

Bill Gates shares with Mark Zuckerberg his prior personal experiences of testifying on behalf of Microsoft before U.S. Congress. Both drop out of Harvard to

2019-04-23 19:45:00 Tuesday ET

Income and wealth concentration follows the ebbs and flows of the business cycle in America. Economic inequality not only grows among people, but it also gr

2023-07-14 10:32:00 Friday ET

Ray Fair applies his macroeconometric model to study the central features of the U.S. macroeconomy such as price stability and full employment in the dual m

2022-03-25 09:34:00 Friday ET

Corporate cash management The empirical corporate finance literature suggests four primary motives for firms to hold cash. These motives include the tra