BlackRock Virginia Municipal Bond Trust (the Trust) is a closed-end management investment company. The Trust's investment objective is to provide current income exempt from regular U.S. federal income tax and Virginia personal income taxes. It invests primarily in municipal bonds exempt from U.S. federal income taxes and Virginia personal income taxes. The Trust invests, under normal market conditions; at least 80% of its managed assets in municipal bonds that are investment grade quality at the time of investment or, if unrated, determined to be of comparable quality at the time of investment by the Trust's investment adviser. The Trust may invest directly in such securities or synthetically through the use of derivatives. » Full Overview of BHV ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-15 13:35:00 Tuesday ET

Americans continue to keep their financial New Year resolutions. First, Americans should save more money. Everyone needs a budget to ensure that key paychec

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2019-12-19 14:43:00 Thursday ET

JPMorgan Chase CEO Jamie Dimon views wealth inequality as a major economic problem in America. Dimon now warns that the rich Americans have been getting wea

2019-10-19 16:35:00 Saturday ET

European economic integration seems to have gone backwards primarily due to the recent Brexit movement. Brexit, key European sovereign debt, and French and

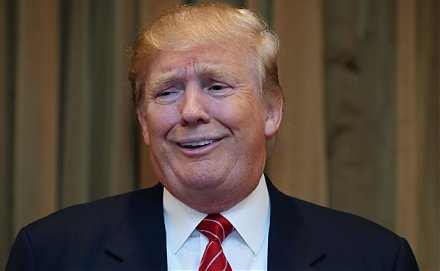

2016-11-08 00:00:00 Tuesday ET

Donald Trump defies the odds to become the new U.S. president. He wants to make America great again. He seeks to repeal Obamacare. He has zero tole

2023-03-07 11:29:00 Tuesday ET

Former Bank of England Governor Mervyn King provides his deep substantive analysis of the Global Financial Crisis of 2008-2009. Mervyn King (2017) &nb