B&G Foods, Inc. along with its subsidiaries manufactures, sells and distributes high quality, shelf stable, frozen food and household products across the U.S., Canada and Puerto Rico. It boasts of a diversified portfolio of brands like Back to Nature, B&G, B&M, Cream of Wheat, Green Giant, Las Palmas, Le Sueur, Mama Mary's, Maple Grove Farms, Mrs. Dash, etc. It has acquired and integrated more than 45 brands. In order to meet production need, it procures a range of raw materials such as agricultural items as well as meat, poultry and flour amongst others. Ingredients and packaging materials are sourced from growers, commodity processors other food companies and packaging suppliers. It also engages in institutional, foodservice and private label sales. It sells, distributes and markets products to supermarkets, mass merchants, warehouse clubs, specialty food distributors, wholesalers, foodservice distributors and direct accounts, military commissaries and non-food outlets such as drug and dollar store chains....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-03-17 09:35:00 Saturday ET

Facebook faces a major data breach by Cambridge Analytica that has harvested private information from more than 50 million Facebook users. In a Facebook pos

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu

2019-10-03 17:39:00 Thursday ET

President Trump indicates that he would consider an interim Sino-American trade deal in lieu of a full trade agreement. The Trump administration defers high

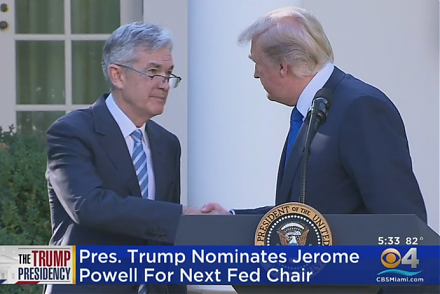

2017-10-03 18:39:00 Tuesday ET

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's

2024-03-19 03:35:58 Tuesday ET

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2024-04-30 09:30:00 Tuesday ET

With clean and green energy resources and electric vehicles, the global auto industry now navigates at a newer and faster pace. Both BYD and Tesla have