Franklin Resources, Inc. is a global investment management company. The majority of its operating revenues and net income is derived from offering investment management and related services to retail mutual funds, institutional and private accounts, and other investment products. The mutual funds and other products are sold to the public under different brands like Franklin, Templeton, Legg Mason, Balanced Equity Management, Benefit Street Partners, Brandywine Global Investment Management and Clarion Partners. Franklin's principal line of business provides investment advisory and management services to investors worldwide through products that include U.S. and non-U.S.-registered open-end and closed-end funds, unregistered funds, and institutional, high net-worth and separately-managed accounts. It offers an array of fixed income, equity, multi-asset, alternative, and cash management asset classes and solutions....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-09-27 11:41:00 Thursday ET

Michael Kors pays $2.3 billion to acquire the Italian elite fashion brand Versace. In accordance with Michael Kors's 5-year plan, the joint company grow

2020-03-26 10:31:00 Thursday ET

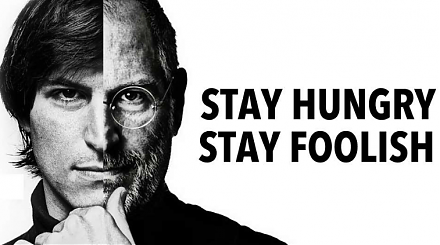

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading

2018-05-10 07:37:00 Thursday ET

Top money managers George Soros and Warren Buffett reveal their current stock and bond positions in their recent corporate disclosures as of mid-2018. Georg

2022-04-05 17:39:00 Tuesday ET

Corporate diversification theory and evidence A recent strand of corporate diversification literature spans at least three generations. The first generat

2018-05-19 09:29:00 Saturday ET

Treasury Secretary Steve Mnuchin indicates that the Trump team puts the trade war with China on hold. The interim suspension of U.S. tariffs should offer in

2018-09-09 13:42:00 Sunday ET

Warren Buffett shares his key insights into life, success, money, and interpersonal communication. Institutional money managers and retail investors ca