2018-02-01 07:38:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

U.S. senators urge the Trump administration with a bipartisan proposal to prevent the International Monetary Fund (IMF) from bailing out several countries that face predatory Chinese loans. These predatory Chinese loans are part of the Belt-and-Road infrastructure development plan for the next decade. Belt-and-Road is a $8 trillion global infrastructure plan that the Xi administration now uses to expand its economic prowess around the world.

In effect, the Xi administration makes productive use of this infrastructure debt to control the economic policies in Asian countries such as Sri Lanka and Pakistan. President Xi intends to transform Belt-and-Road into a new world economic order with fresh and unique Chinese dominance.

U.S. State Secretary Mike Pompeo points out that at least 23 of these 68 Belt-and-Road countries now face financial debt difficulties. This debt distress signals the collective reliance of Belt-and-Road countries on China. Also, China holds about $1.2 trillion U.S. Treasury bonds, bills, and notes and hence can directly influence the U.S. yield curve. Should the Belt-and-Road countries fail to honor their principal and interest payments on their current debt contracts with China in the absence of IMF bailout finance, the Xi administration may unload its Treasury bond positions. In turn, China may effectively use its rich foreign reserves to entrench its current 260% public-debt-to-GDP ratio and Belt-and-Road infrastructure debt distress.

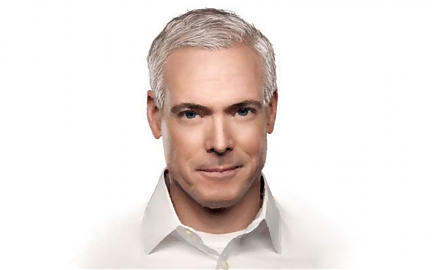

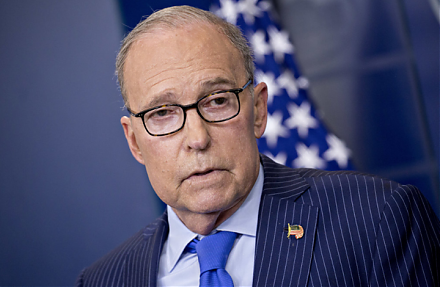

In the worst-case scenario, these ripple effects may inadvertently cause U.S. yield curve inversion. U.S. yield curve inversion reflects a negative term spread between short-term and long-term interest rates, indicates corporate investment sentiments with respect to mergers and acquisitions and capital expenditures, and hence often recurs in the early dawn of a severe economic recession. This red alert poses a major gray rhino, or some obvious highly probable negative incidence, in contrast to improbable black-swan rare events such as the U.S. subprime mortgage crisis, the European sovereign debt spiral, and the Global Great Depression. For these legitimate reasons, the Trump administration's advisors such as Pompeo, Mnuchin, and Kudlow need to alleviate this economic security concern in due course.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-08-19 10:32:00 Wednesday ET

Corporate strategies, portfolio choices, and management memes add value and drive business process improvements over time. Andrew Campbell, Jo Whitehead,

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2018-01-17 05:30:00 Wednesday ET

European Union antitrust regulators impose a fine on Qualcomm for advancing its key exclusive microchip deal with Apple to block out rivals such as Intel an

2020-07-05 11:31:00 Sunday ET

Business entrepreneurs dare to dream, remain true and authentic to themselves, and try to make a great social impact in the world. Alex Malley (2014)

2023-03-21 11:28:00 Tuesday ET

Barry Eichengreen compares the Great Depression of the 1930s and the Great Recession as historical episodes of economic woes. Barry Eichengreen (2016)

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins