Beacon Financial Corporation is the holding Company for Beacon Bank & Trust a full-service regional bank serving. The Bank operates through its banking divisions Berkshire Bank, Brookline Bank, BankRI and PCSB Bank. Beacon Financial Corporation, formerly known as Berkshire Hills Bancorp Inc., is based in BOSTON....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2016-10-01 00:00:00 Saturday ET

We can learn much from the frugal habits and lifestyles of several billionaires on earth. Warren Buffett, Chairman and CEO of Berkshire Hathaway, still l

2023-12-04 12:30:00 Monday ET

Bank leverage and capital bias adjustment through the macroeconomic cycle Abstract We assess the quantitative effects of the recent proposal

2018-12-11 10:34:06 Tuesday ET

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stan

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu

2019-09-13 10:37:00 Friday ET

China allows its renminbi currency to slide below the key psychologically important threshold of 7-yuan per U.S. dollar. A currency dispute between the U.S.

2023-05-14 12:31:00 Sunday ET

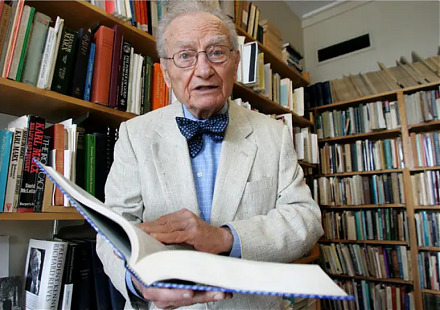

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m