Basic Energy Services, Inc. provides well site services to oil and natural gas drilling and producing companies in the United States. The company operates through Completion and Remedial Services, Well Servicing, Water Logistics, and Contract Drilling segments. The Completion and Remedial Services segment offers pumping services, such as cementing, acidizing, fracturing, nitrogen, and pressure testing; rental and fishing tools; coiled tubing; snubbing services; thru-tubing; underbalanced drilling in low pressure and fluid sensitive reservoirs; and cased-hole wireline services. The Well Servicing segment provides services performed with a mobile well servicing rig and ancillary equipment, such as maintenance work, hoisting tools and equipment required by the operation, and plugging and abandonment services, as well as manufactures and sells workover rigs. As of December 31, 2018, this segment operated a fleet of 310 well servicing rigs. The Water Logistics segment is involved in the transportation of fluids; saltwater production; sale and transportation of fresh and brine water; rental of portable fracturing and test tanks; recycling and treatment of wastewater; operation of fresh water and brine source wells, and non-hazardous wastewater disposal wells; and preparation, construction, and maintenance of access roads, drilling locations, and production facilities. As of December 31, 2017, this segment owned and operated 823 fluid service trucks with an average fluid hauling capacity of up to 150 barrels apiece; and owned 83 saltwater disposal facilities. The Contract Drilling segment employs drilling rigs and related equipment to penetrate the earth to a desired depth and initiate production. This segment owns and operates 11 land drilling rigs. The company was formerly known as Sierra Well Service, Inc. and changed its name to Basic Energy Services, Inc. in 2000. Basic Energy Services, Inc. was founded in 1992 and is headquartered in Fort Worth, Texas....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2022-05-25 09:31:00 Wednesday ET

Net stock issuance theory and practice Net equity issuance can be in the form of initial public offering (IPO) or seasoned equity offering (SEO). This l

2017-12-19 09:39:00 Tuesday ET

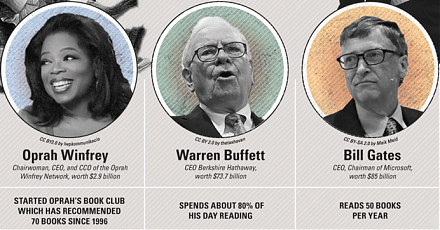

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2019-07-25 16:42:00 Thursday ET

Platforms benefit from positive network effects, scale economies, and information cascades. There are at least 2 major types of highly valuable platforms: i

2017-11-05 09:45:00 Sunday ET

President Trump criticizes the potential media merger between AT&T and Time Warner, the latter of which owns the anti-Trump media network CNN. President