Brookfield Asset Management Inc. is an alternative asset manager with assets under management across real estate, infrastructure, renewable power and transition, private equity and credit. It offers a range of alternative investment products to investors including public and private pension plans, endowments and foundations, sovereign wealth funds, financial institutions, insurance companies and private wealth investors. Brookfield Asset Management Inc. is based in Toronto, Canada....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 12 July 2025

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2018-05-21 07:39:00 Monday ET

Dodd-Frank rollback raises the asset threshold for systemically important financial institutions (SIFIs) from $50 billion to $250 billion. This legislative

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2019-01-03 10:38:00 Thursday ET

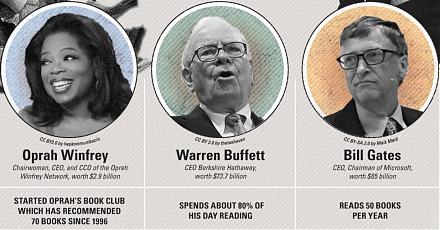

American parents often worry about money and upward mobility for their children. A recent New York Times survey suggests that nowadays American parents spen

2022-02-02 10:33:00 Wednesday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2022. As of early-January 2023, the U.S. Patent and Trademark O

2020-07-19 09:25:00 Sunday ET

Senior business leaders can learn much from the lean production system with iterative continuous improvements at Toyota. Takehiko Harada (2015)