AVEO Pharmaceuticals, Inc. is a biopharmaceutical company engaged in discovering, developing and commercializing novel cancer therapeutics. Its product candidates are targeted against important mechanisms known or believed to be involved in cancer. Tivozanib, the Company's lead product candidate, is a highly potent and selective oral inhibitor of the vascular endothelial growth factor, or VEGF, receptors 1, 2 and 3. In addition to tivozanib, AVEO Pharmaceuticals has a pipeline of monoclonal antibodies derived from Human Response Platform (HRP), a novel method of building preclinical models of human cancer, which are intended to more accurately represent cancer biology in patients. AV-299 is the Company's next product candidate which is an antibody that binds to hepatocyte growth factor, or HGF, thereby blocking its function. AVEO Pharmaceuticals, Inc. is based in Cambridge, Massachusetts....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2020-07-05 11:31:00 Sunday ET

Business entrepreneurs dare to dream, remain true and authentic to themselves, and try to make a great social impact in the world. Alex Malley (2014)

2020-02-12 09:31:00 Wednesday ET

Mark Zuckerberg develops Facebook as a social network platform to help empower global connections among family and friends. David Kirkpatrick (2011) T

2018-01-04 07:36:00 Thursday ET

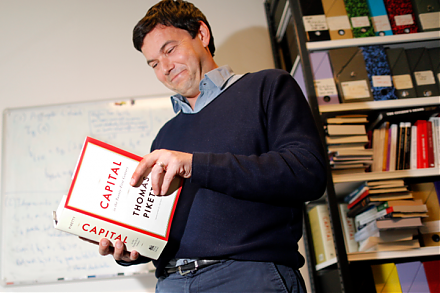

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2018-05-10 07:37:00 Thursday ET

Top money managers George Soros and Warren Buffett reveal their current stock and bond positions in their recent corporate disclosures as of mid-2018. Georg

2018-12-17 08:43:00 Monday ET

Apple files an appeal to overturn the recent iPhone sales ban in China due to its patent infringement of Qualcomm proprietary technology. This recent ban of

2025-09-16 09:27:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund