Astec Industries Inc. is a leading manufacturer and marketer of road building equipment. The company sells equipment used in each phase of road building, from quarrying and crushing the aggregate to applying the asphalt. Astec also manufactures equipment and components unrelated to road construction, including equipment for the mining, quarrying, construction and demolition industries and port and rail yard operators, gas and oil drilling rigs, water well and geothermal drilling rigs, industrial heat transfer equipment, commercial whole-tree pulpwood chippers, horizontal grinders, blower trucks, concrete plants, commercial and industrial burners, and combustion control systems. It has two segments. Infrastructure Solutions - Its products include road building, asphalt and concrete plant equipment, thermal and storage solutions as well as wood grinding equipment. Materials Solutions - Its products include crushing and screening, washing and classifying, plants and systems and material handling equipment....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-10-01 11:33:00 Tuesday ET

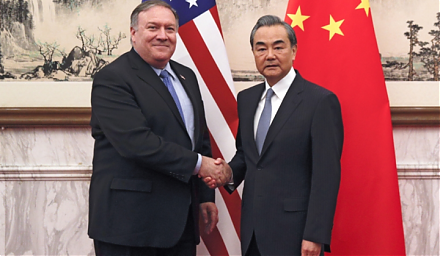

The Trump administration postpones increasing 25% to 30% tariffs on $250 billion Chinese imports after China extends an olive branch to de-escalate Sino-Ame

2022-10-15 09:34:00 Saturday ET

Internal capital markets and financial constraints Duchin (JF 2010) empirically finds that multidivisional firms with robust internal capital markets ret

2018-05-23 09:41:00 Wednesday ET

Many U.S. large public corporations spend their tax cuts on new dividend payout and share buyback but not on new job creation and R&D innovation. These

2025-06-20 08:27:00 Friday ET

President Trump poses new threats to Fed Chair monetary policy independence again. We describe, discuss, and delve into the mainstream reasons, conc

2026-02-02 12:30:00 Monday ET

With U.S. fintech patent approval, accreditation, and protection for 20 years, our proprietary alpha investment model outperforms most stock market indexes

2019-11-26 11:30:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube November 2019 In this podcast, we discuss several topical issues as of November 2019: (1) The Trump adm