ArQule, Inc., a biopharmaceutical company, researches and develops therapeutics for the treatment of cancer and rare diseases in the United States. The company's pipeline includes ARQ 531, an orally bioavailable, potent and reversible dual inhibitor of wild type and C481S-mutant Bruton's tyrosine kinase that is in Phase I trial for patients with B-cell malignancies refractory to other therapeutic options; and miransertib (ARQ 092), a potent and selective inhibitor of the protein kinase B (AKT), a serine/threonine kinase, which is in Phase Ib in combination with the hormonal therapy and anastrozole in patients with advanced endometrial cancer. Its pipeline also comprises ARQ 75, a potent and selective inhibitor of AKT that is in Phase I clinical development for solid tumors harboring AKT, phosphoinositide 3-kinase or phosphatase, and tensin homolog loss mutations. In addition, the company's pipeline includes Derazantinib (ARQ 087), a multi-kinase inhibitor designed to preferentially inhibit the fibroblast growth factor receptor (FGFR) family of kinases that is in a registrational clinical trial in intrahepatic cholangiocarcinoma in patients with FGFR2 fusions. ArQule, Inc. has license agreements with Basilea Pharmaceutica Limited and Roivant Sciences Ltd. The company was founded in 1993 and is headquartered in Burlington, Massachusetts....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-05-05 07:33:00 Saturday ET

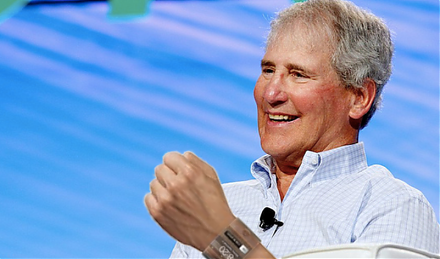

Warren Buffett shares his fresh economic insights and value investment strategies at the Berkshire Hathaway shareholder forum in May 2018 despite the new GA

2022-02-05 09:26:00 Saturday ET

Modern themes and insights in behavioral finance Shiller, R.J. (2003). From efficient markets theory to behavioral finance. Journal of Economi

2020-02-26 09:30:00 Wednesday ET

Goldman Sachs follows the timeless business principles and best practices in financial market design and investment management. William Cohan (2011) M

2018-12-21 11:39:00 Friday ET

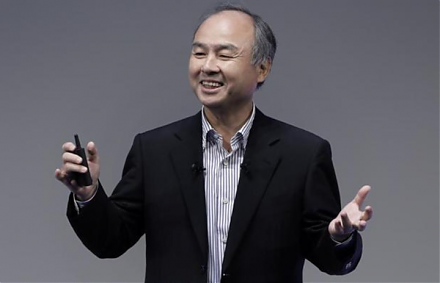

The Internet and telecom conglomerate SoftBank Group raises $23 billion in the biggest IPO in Japan. Going public is part of the major corporate move away f

2020-07-12 08:30:00 Sunday ET

The lean CEO encourages iterative continuous improvements and collaborative teams to innovate around core value streams. Jacob Stoller (2015)

2020-11-03 08:30:00 Tuesday ET

Agile lean enterprises break down organizational silos to promote smart collaboration for better profitability and customer loyalty. Heidi Gardner (2017