ArQule, Inc., a biopharmaceutical company, researches and develops therapeutics for the treatment of cancer and rare diseases in the United States. The company's pipeline includes ARQ 531, an orally bioavailable, potent and reversible dual inhibitor of wild type and C481S-mutant Bruton's tyrosine kinase that is in Phase I trial for patients with B-cell malignancies refractory to other therapeutic options; and miransertib (ARQ 092), a potent and selective inhibitor of the protein kinase B (AKT), a serine/threonine kinase, which is in Phase Ib in combination with the hormonal therapy and anastrozole in patients with advanced endometrial cancer. Its pipeline also comprises ARQ 75, a potent and selective inhibitor of AKT that is in Phase I clinical development for solid tumors harboring AKT, phosphoinositide 3-kinase or phosphatase, and tensin homolog loss mutations. In addition, the company's pipeline includes Derazantinib (ARQ 087), a multi-kinase inhibitor designed to preferentially inhibit the fibroblast growth factor receptor (FGFR) family of kinases that is in a registrational clinical trial in intrahepatic cholangiocarcinoma in patients with FGFR2 fusions. ArQule, Inc. has license agreements with Basilea Pharmaceutica Limited and Roivant Sciences Ltd. The company was founded in 1993 and is headquartered in Burlington, Massachusetts....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-03-03 10:39:00 Sunday ET

Tech companies seek to serve as quasi-financial intermediaries. Retail traders can list items for sale on eBay and then acquire these items economically on

2019-11-26 11:30:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube November 2019 In this podcast, we discuss several topical issues as of November 2019: (1) The Trump adm

2018-01-25 08:32:00 Thursday ET

After its flagship iPhone X launch, Apple reports its highest quarterly sales revenue over $80 billion in the tech titan's 41-year history. Apple expect

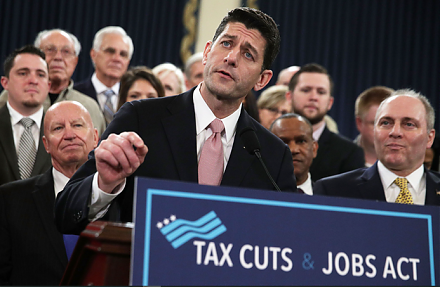

2017-11-17 09:42:00 Friday ET

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2017-12-21 12:45:00 Thursday ET

Tony Robbins summarizes several personal finance and investment lessons for the typical layperson: We cannot beat the stock market very often, so it w

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham