AxonPrime Infrastructure Acquisition Corporation is a blank check company. It intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or related business combination with one or more businesses. AxonPrime Infrastructure Acquisition Corporation is based in New York....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2022-03-05 09:27:00 Saturday ET

Addendum on empirical tests of multi-factor models for asset return prediction Fama and French (2015) propose an empirical five-factor asset pricing mode

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t

2017-04-25 06:35:00 Tuesday ET

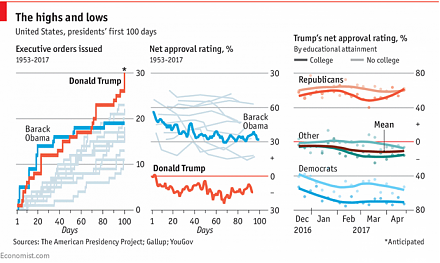

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities

2018-06-17 10:35:00 Sunday ET

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow th

2019-01-05 11:39:00 Saturday ET

Reuters polls show that most Americans blame President Trump for the recent U.S. government shutdown. President Trump remains adamant about having to shut d