Alpha and Omega Semiconductor Limited is engaged in designing, developing and supplying a broad range of power semiconductors globally, including a portfolio of Power MOSFET and Power IC products. The Company seeks to differentiate itself by integrating its expertise in device physics, process technology, design and advanced packaging to optimize product performance and cost. Its portfolio of products targets high-volume end-market applications, such as notebooks, netbooks, flat panel displays, mobile phone battery packs, set-top boxes, portable media players and power supplies. The products are incorporated into devices by original equipment manufacturers, or OEMs. The Company utilizes third-party foundries for all of its wafer fabrication and it deploys and implements its proprietary MOSFET processes at these third party foundries. The Company relies upon its in-house capacity and an associated provider for most of its packaging and testing requirements....

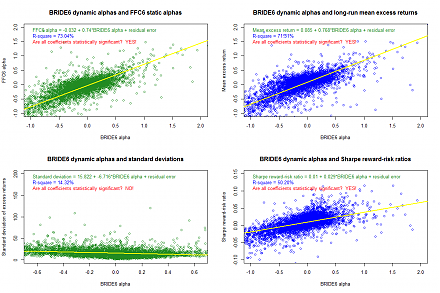

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-12-17 08:43:00 Monday ET

Apple files an appeal to overturn the recent iPhone sales ban in China due to its patent infringement of Qualcomm proprietary technology. This recent ban of

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2017-12-01 06:30:00 Friday ET

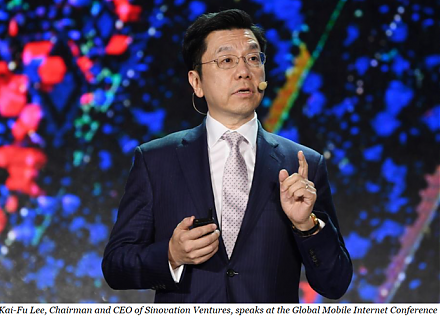

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2017-11-25 06:34:00 Saturday ET

Mario Draghi, President of the European Central Bank, heads the international committee of financial supervisors and has declared their landmark agreement o

2019-10-27 17:37:00 Sunday ET

International climate change can cause an adverse impact on long-term real GDP economic growth. USC climate change economist Hashem Pesaran and his co-autho

2017-06-15 07:32:00 Thursday ET

President Donald Trump has discussed with the CEOs of large multinational corporations such as Apple, Microsoft, Google, and Amazon. This discussion include