Anworth Mortgage Asset Corp. was formed to invest in mortgage assets,including mortgage pass-through certificates, collateralized mortgageobligations, mortgage loans and other securities representing interests in, or obligations backed by, pools of mortgage loans which can be readily financed and short-term investments. The Company intends to acquire mortgage assets primarily in the secondary mortgage market through its manager, Anworth Mortgage Advisory Corporation....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-06-02 09:35:00 Saturday ET

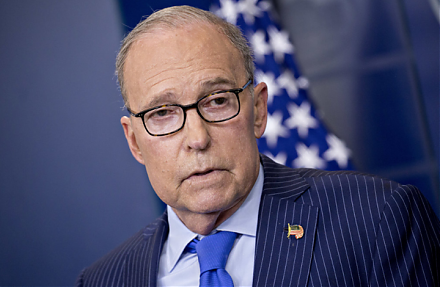

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchi

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2019-10-23 15:39:00 Wednesday ET

American CEOs of about 200 corporations issue a joint statement in support of stakeholder value maximization. The Business Roundtable offers this statement

2019-04-13 14:28:00 Saturday ET

Saudi Aramco unveils the financial secrets of the most profitable corporation in the world. In its recent public bond issuance prospectus, Aramco offers the

2019-12-10 09:30:00 Tuesday ET

Federal Reserve institutes the third interest rate cut with a rare pause signal. The Federal Open Market Committee (FOMC) reduces the benchmark interest rat

2019-04-30 19:46:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube April 2019 In this podcast, we discuss several topical issues as of April 2019: (1) Our proprietary