American Midstream Partners, LP, incorporated on August 20, 2009, owns, operates, develops and acquires a portfolio of midstream energy assets. The Company provides midstream infrastructure that links producers of natural gas, crude oil, natural gas liquids (NGLs), condensate and specialty chemicals to numerous intermediate and end-use markets. Its segments include gathering and processing, transmission and terminals. Through its segments, it is engaged in the business of gathering, treating, processing, and transporting natural gas; gathering, transporting, storing, treating and fractionating NGLs; gathering, storing and transporting crude oil and condensates, and storing specialty chemical products. Its primary assets are located in some of the prolific onshore and offshore producing regions and various markets in the United States. Its gathering and processing assets are primarily located in the Permian Basin of West Texas; the Cotton Valley/Haynesville Shale of East Texas; the Eagle Ford Shale of South Texas; the Bakken Shale of North Dakota, and offshore in the Gulf of Mexico. Its transmission and terminal assets are located in various markets in North Texas, Louisiana, Mississippi and Tennessee. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-12-19 17:41:00 Wednesday ET

Tencent Music Entertainment debuts its IPO on NYSE to strike a chord with stock market investors. Tencent Music goes public and marks the biggest IPO by a m

2017-08-25 13:36:00 Friday ET

The U.S. Treasury's June 2017 grand proposal for financial deregulation aims to remove several aspects of the Dodd-Frank Act 2010 such as annual macro s

2018-12-11 10:34:06 Tuesday ET

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stan

2023-01-11 09:26:00 Wednesday ET

Addendum on USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S

2022-02-25 00:00:00 Friday ET

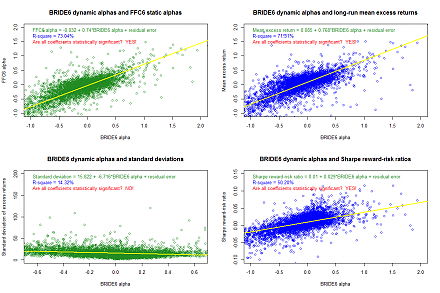

Empirical tests of multi-factor models for asset return prediction The capital asset pricing model (CAPM) of Sharpe (1964), Lintner (1965), and Bla

2018-03-23 08:26:00 Friday ET

Personal finance and investment author Thomas Corley studies and shares the rich habits of self-made millionaires. Corley has spent 5 years studying the dai