Affiliated Managers Group, Inc. (AMG) is a global asset management company with equity investments in leading boutique investment management firms. AMG's strategy is to generate shareholder value through the growth of existing affiliates, as well as through investments in new affiliates and additional investments in existing affiliates. In addition, AMG provides centralized assistance to its Affiliates in strategic matters, marketing, distribution, product development and operations. AMG's Affiliates offer over many investment products across a broad array of active, alpha-oriented strategies, to institutional and retail clients around the world. AMG offers investors a unique opportunity to participate in the growth of a diverse group of high quality boutique investment management firms. Through its Affiliates, AMG offers investment products across a wide range of investment styles and asset classes to mutual fund, institutional and high net worth investors....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-04-21 10:07:54 Sunday ET

Central bank independence remains important for core inflation containment in the current age of political populism. In accordance with the dual mandate of

2017-11-13 07:42:00 Monday ET

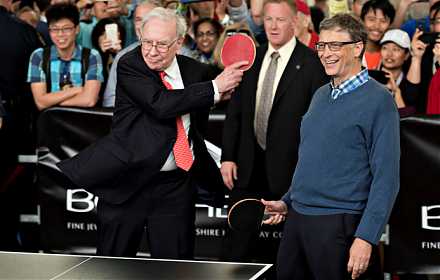

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2023-08-14 09:25:00 Monday ET

Peter Isard analyzes the proper economic policy reforms and root causes of global financial crises of the 1990s and 2008-2009. Peter Isard (2005) &nbs

2018-01-19 11:32:00 Friday ET

Most major economies grow with great synchronicity several years after the global financial crisis. These economies experience high stock market valuation,

2020-04-24 11:33:00 Friday ET

Disruptive innovations tend to contribute to business success in new blue-ocean markets after iterative continuous improvements. Clayton Christensen and

2022-09-25 09:34:00 Sunday ET

Main reasons for share repurchases Temporary market undervaluation often induces corporate incumbents to initiate a share repurchase program to boost the