AMC Entertainment Holdings, Inc., operates as a theatrical exhibition company primarily in the United States and internationally. It owned or interests in theatres and screens. AMC Entertainment Holdings, Inc. is based in Leawood, Kansas....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-12-03 11:33:00 Sunday ET

Macro innovations and asset alphas show significant mutual causation. April 2023 This brief article draws from the recent research publicati

2023-11-07 11:31:00 Tuesday ET

Joel Mokyr suggests that economic growth arises from a change in cultural beliefs toward technological progress. Joel Mokyr (2018) A culture

2019-06-11 12:33:00 Tuesday ET

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview wit

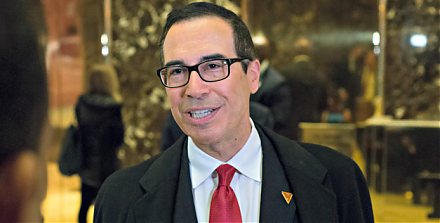

2017-05-25 08:35:00 Thursday ET

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2023-08-28 08:26:00 Monday ET

Jared Diamond delves into how some societies fail, succeed, and revive in global human history. Jared Diamond (2004) Collapse: how societies

2019-10-15 09:13:00 Tuesday ET

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no