Alio Gold Inc., through its subsidiaries, engages in the acquisition, exploration, development, and operation of mineral resource properties. The company primarily mines for gold and silver. It holds 100% interests in San Francisco open pit gold mine that covers an area of approximately 53,380 hectares situated in the north central portion of the state of Sonora, Mexico; Florida Canyon open pit mine covering an area of approximately 11,886 hectares located in Nevada, the United States; and Ana Paula property situated in the state of Guerrero, Mexico. The company was formerly known as Timmins Gold Corp. and changed its name to Alio Gold Inc. in May 2017. Alio Gold Inc. was incorporated in 2005 and is headquartered in Vancouver, Canada....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

2018-11-09 11:35:00 Friday ET

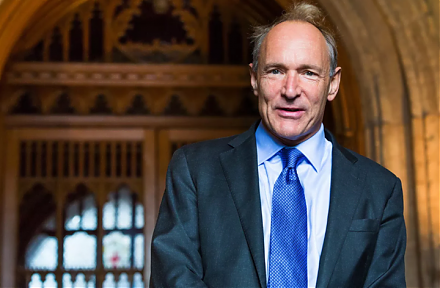

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2018-09-07 07:33:00 Friday ET

The Economist re-evaluates the realistic scenario that the world has learned few lessons of the global financial crisis from 2008 to 2009 over the past deca

2018-09-25 10:35:00 Tuesday ET

Sirius XM pays $3.5 billion shares to acquire the music app company Pandora. This acquisition would form the largest audio entertainment company worldwide.

2023-06-19 10:31:00 Monday ET

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

2023-04-14 13:32:00 Friday ET

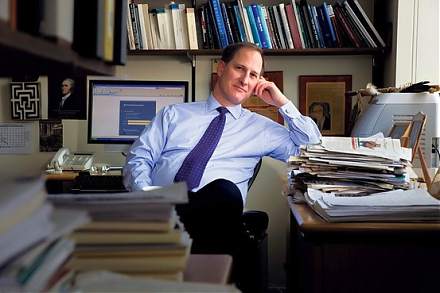

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an