Alder Biopharmaceuticals, Inc., incorporated on May 20, 2002, is a clinical-stage biopharmaceutical company. The Company discovers, develops and seeks to commercialize genetically engineered therapeutic antibodies with the potential to transform existing treatment paradigms. Alder's lead pivotal-stage product candidate, eptinezumab, is being evaluated for migraine prevention. Eptinezumab is a monoclonal antibody that inhibits calcitonin gene-related peptide (CGRP), a protein that is active in mediating the initiation of migraine. Alder is additionally evaluating ALD1910, a preclinical product candidate also in development as a migraine prevention therapy. ALD1910 is a monoclonal antibody that inhibits pituitary adenylate cyclase-activating polypeptide-38 (PACAP-38), another protein that is active in mediating the initiation of migraine. Clazakizumab, Alder's third program, is a monoclonal antibody candidate that inhibits interleukin-6 and is licensed to Vitaeris, Inc. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-05-14 12:31:00 Sunday ET

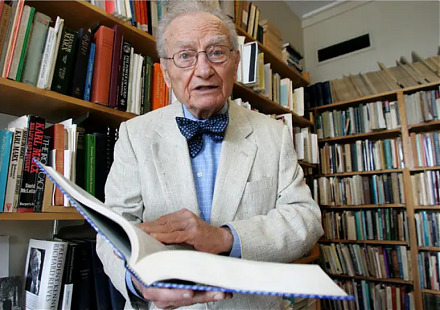

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2020-05-28 15:37:00 Thursday ET

Platform enterprises leverage network effects, scale economies, and information cascades to boost exponential business growth. Laure Reillier and Benoit

2017-05-13 07:28:00 Saturday ET

America's Top 5 tech firms, Apple, Alphabet, Microsoft, Amazon, and Facebook have become the most valuable publicly listed companies in the world. These

2019-05-07 09:30:00 Tuesday ET

The Trump team receives a 3.2% first-quarter GDP boost as Fed Chair Jay Powell halts the next interest rate hike in early-May 2019. This smooth upward econo

2019-10-23 15:39:00 Wednesday ET

American CEOs of about 200 corporations issue a joint statement in support of stakeholder value maximization. The Business Roundtable offers this statement

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J