Alder Biopharmaceuticals, Inc., incorporated on May 20, 2002, is a clinical-stage biopharmaceutical company. The Company discovers, develops and seeks to commercialize genetically engineered therapeutic antibodies with the potential to transform existing treatment paradigms. Alder's lead pivotal-stage product candidate, eptinezumab, is being evaluated for migraine prevention. Eptinezumab is a monoclonal antibody that inhibits calcitonin gene-related peptide (CGRP), a protein that is active in mediating the initiation of migraine. Alder is additionally evaluating ALD1910, a preclinical product candidate also in development as a migraine prevention therapy. ALD1910 is a monoclonal antibody that inhibits pituitary adenylate cyclase-activating polypeptide-38 (PACAP-38), another protein that is active in mediating the initiation of migraine. Clazakizumab, Alder's third program, is a monoclonal antibody candidate that inhibits interleukin-6 and is licensed to Vitaeris, Inc. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-08-19 10:34:00 Sunday ET

The World Economic Forum warns that artificial intelligence may destabilize the financial system. Artificial intelligence poses at least a trifecta of major

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

2018-02-23 09:35:00 Friday ET

Warren Buffett releases his annual letter to Berkshire Hathaway shareholders as of February 2018. Buffett discusses Berkshire's core cash ambition, its

2023-11-21 11:32:00 Tuesday ET

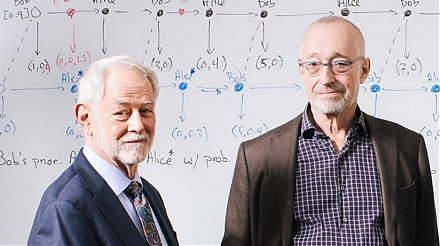

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2025-09-24 09:49:53 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2024-10-14 11:33:00 Monday ET

Stock Synopsis: Video games continue to take both screen time and monetization from many other forms of entertainment. We are broadly positive about the