AgileThought Inc. is a provider of digital transformation services, custom software development and next-generation technologies. It serves architects, developers, data scientists, engineers, transformation consultants, automation specialists and other experts. AgileThought Inc., formerly known as LIV Capital Acquisition Corp., is based in IRVING, Texas....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-12-03 11:33:00 Sunday ET

Macro innovations and asset alphas show significant mutual causation. April 2023 This brief article draws from the recent research publicati

2018-10-27 09:34:00 Saturday ET

U.S. automobile and real estate sales decline despite higher consumer confidence and low unemployment as of October 2018. This slowdown arises from the curr

2023-11-28 11:35:00 Tuesday ET

David Colander and Craig Freedman argue that economics went wrong when there was no neoclassical firewall between economic theories and policy reforms. D

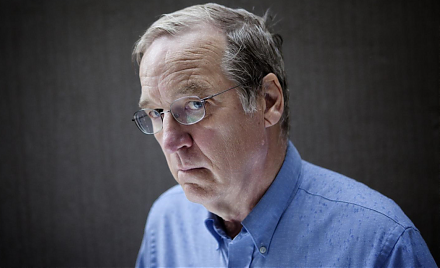

2023-03-07 11:29:00 Tuesday ET

Former Bank of England Governor Mervyn King provides his deep substantive analysis of the Global Financial Crisis of 2008-2009. Mervyn King (2017) &nb

2020-04-24 11:33:00 Friday ET

Disruptive innovations tend to contribute to business success in new blue-ocean markets after iterative continuous improvements. Clayton Christensen and

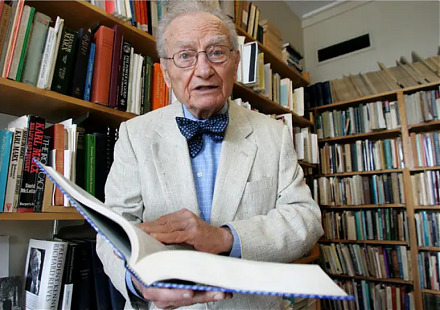

2023-05-14 12:31:00 Sunday ET

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m