Aesther Healthcare Acquisition Corp. entered into definitive merger agreement with Ocean Biomedical, Inc....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 28 June 2025

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2022-05-30 09:32:00 Monday ET

The new semiconductor microchip demand-supply imbalance remains quite severe for the U.S. tech and auto industries. Our current fundamental macro a

2020-03-26 10:31:00 Thursday ET

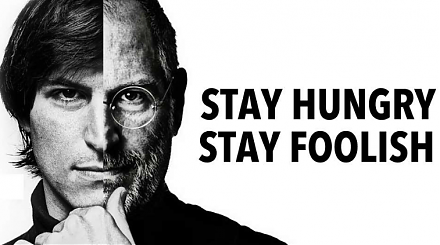

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading

2018-03-01 07:35:00 Thursday ET

Trump imposes high tariffs on steel (25%) and aluminum (10%) in a new trade war with subsequent exemptions for Canada and Mexico. The Trump administration&#

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod

2024-05-05 10:31:00 Sunday ET

Stock Synopsis: Pharmaceutical post-pandemic patent development cycle In terms of stock market valuation, the major pharmaceutical sector remains at its