Ascent Industries Co. encompasses a portfolio of manufacturing businesses including Manufacturers Chemicals, DanChem, CRI Tolling, Bristol Tubular Products, Specialty Pipe & Tube, the stainless steel and galvanized pipe and tube operations of Marcegaglia USA, and American Stainless Tubing. Ascent Industries Co., formerly known as Synalloy Corporation, is based in Oak Brook, Illinois....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 12 July 2025

2023-07-28 11:28:00 Friday ET

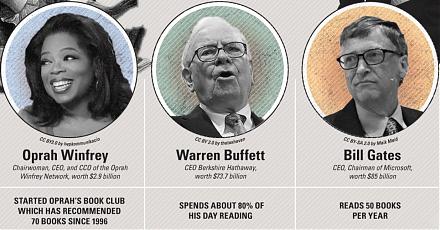

Lucian Bebchuk and Jesse Fried critique that executive pay often cannot help explain the stock return and operational performance of most U.S. public corpor

2024-02-04 08:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2024. Our proprietary alpha investment model outperforms the ma

2017-05-25 08:35:00 Thursday ET

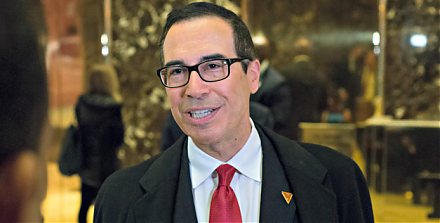

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2020-03-19 13:39:00 Thursday ET

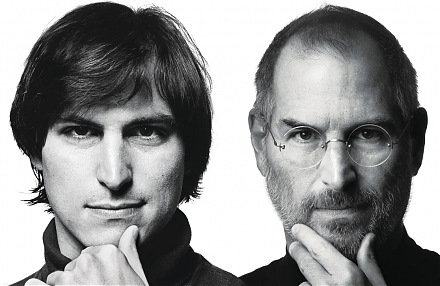

The business legacy and sensitivity of Steve Jobs can transform smart mobile devices with Internet connectivity, music and video content curation, and digit

2018-11-09 11:35:00 Friday ET

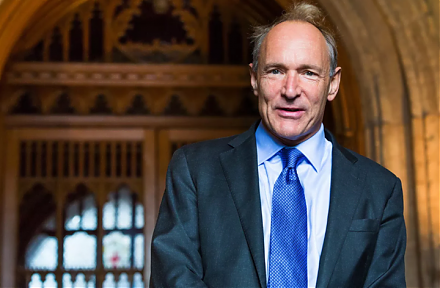

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra