Albertsons Co., Inc. is one of the largest food and drug retailers selling products under categories: Non-perishables, Perishables, Pharmacy and Fuel in the U.S. The company offers grocery products, general merchandise, health and beauty care products, pharmacy, fuel and other items and services. It operates stores across multiple states and the District of Columbia under more than 20 renowned banners including Albertsons, Safeway, Vons, Jewel-Osco, Shaw's, Acme, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star Market, Haggen, Carrs, Kings Food Markets and Balducci's Food Lovers Market. It also provides more than 13,000 high-quality products under its Own Brands portfolio and operates various digital platforms and provides home delivery and Drive Up & Go curbside pickup for online purchases and has partnerships with third parties. It has collaborated with Instacart for rush delivery and DoorDash for the delivery of prepared and ready-to-eat offerings and has teamed up with Uber for fast delivery....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-03-14 16:43:00 Tuesday ET

Several feasible near-term reforms can substantially narrow the scope for global tax avoidance by closing information loopholes. Thomas Pogge and Krishen

2019-11-05 07:41:00 Tuesday ET

The Trump administration expects to reach an interim partial trade deal with China. This interim partial trade deal represents the first phase of a comprehe

2023-04-14 13:32:00 Friday ET

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2023-11-21 11:32:00 Tuesday ET

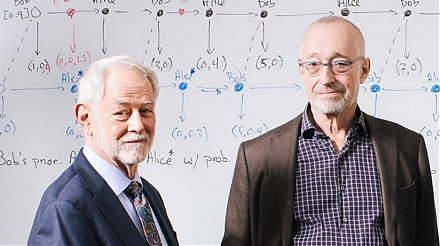

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2020-04-17 07:23:00 Friday ET

Clayton Christensen defines and delves into the core dilemma of corporate innovation with sustainable and disruptive advances. Clayton Christensen (2000)

2019-06-23 08:30:00 Sunday ET

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare