Alcentra Capital Corporation is a business development company specializing in investments in lower middle-market companies. The fund seeks to invest in healthcare, business services, defense, government services, telecom and technology, media, infrastructure maintenance and logistics, and oil and gas services sector. It focuses on investment opportunities headquartered in the United States. The fund seeks to invest $5 million to $15 million per transaction in companies with EBITDA between $5 million to $15 million and revenues of between $10 million and $100 million. It invests in the form of subordinated debt and, to a lesser extent, senior debt and minority equity investments....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-08-05 13:30:00 Monday ET

China continues to sell U.S. Treasury bonds amid Sino-U.S. trade truce uncertainty. In mid-2019, China reduces its U.S. Treasury bond positions by $20.5 bil

2019-11-01 12:31:00 Friday ET

Kourtney Kardashian shares the best money advice from her father. This advice reminds her that money just cannot buy happiness. As the eldest of the Kardash

2025-02-02 11:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2025. Our proprietary alpha investment model outperforms the ma

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go

2019-09-13 10:37:00 Friday ET

China allows its renminbi currency to slide below the key psychologically important threshold of 7-yuan per U.S. dollar. A currency dispute between the U.S.

2017-09-19 05:34:00 Tuesday ET

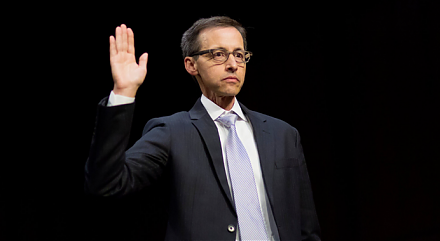

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el