iShares MSCI All Country Asia ex Japan ETF (the Fund), formerly The iShares MSCI All Country Asia ex Japan Index Fund, is an exchange-traded fund (ETF). The Fund seeks investment results that correspond generally to the price and yield performance, of the MSCI All Country Asia ex Japan Index (the Index). The Index is a free-float adjusted market capitalization index designed to measure equity market performance of the 12 countries, such as Australia, China, Honk Kong, India, Indonesia, Malaysia, New Zealand, the Philippines, Singapore, South Korea, Taiwan and Thailand. The Fund generally invests at least 90% of its assets in securities of the Underlying Index and in depositary receipts representing securities of the Underlying Index. BlackRock Fund Advisors (BFA) serves as the investment advisor to the Fund. » Full Overview of AAXJ.A ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-11-03 12:30:00 Sunday ET

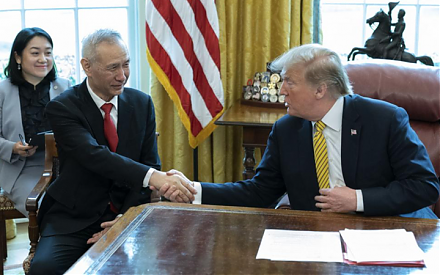

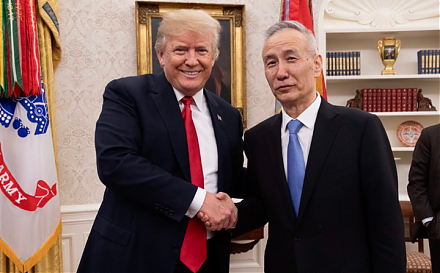

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2019-07-23 09:22:00 Tuesday ET

Harvard economic platform researcher Dipayan Ghosh proposes some alternative solutions to breaking up tech titans such as Facebook, Google, Apple, and Amazo

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su

2022-05-05 09:34:00 Thursday ET

Corporate payout management This corporate payout literature review rests on the recent survey article by Farre-Mensa, Michaely, and Schmalz (2014). Out

2026-01-19 10:30:00 Monday ET

Andy Yeh Alpha (AYA) fintech network platform: major milestones, key product features, and online social media services Introduction