Altisource Asset Management Corp. is an asset management company. The company provide portfolio management and corporate governance services to Real-Estate Investment Trusts and other real-estate portfolio-driven entities. Altisource Asset Management Corp is based in the U.S. Virgin Islands....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-07-13 09:41:00 Friday ET

Yale economist Stephen Roach warns that America has much to lose from the current trade war with China for a few reasons. First, America is highly dependent

2017-04-07 15:34:00 Friday ET

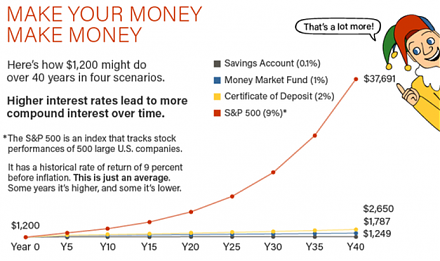

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month? At first glance, this counterintuitive

2020-04-03 09:28:00 Friday ET

The Intel trinity of Robert Noyce, Gordon Moore, and Andy Grove establishes the primary semiconductor tech titan in Silicon Valley. Michael Malone (2014)

2018-09-25 10:35:00 Tuesday ET

Sirius XM pays $3.5 billion shares to acquire the music app company Pandora. This acquisition would form the largest audio entertainment company worldwide.

2018-01-01 06:30:00 Monday ET

As former chairman of the British Financial Services Authority and former director of the London School of Economics, Howard Davies shares his ingenious ins

2017-10-21 08:45:00 Saturday ET

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.