2024-04-30 09:30:00 Tuesday ET

With clean and green energy resources and electric vehicles, the global auto industry now navigates at a newer and faster pace. Both BYD and Tesla have

2020-01-15 08:31:00 Wednesday ET

Anti-competitive corporate practices may stifle U.S. innovation. In recent decades, wage growth, economic output, and productivity tend to stagnate as U.S.

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)

2018-10-25 10:36:00 Thursday ET

Trump tariffs begin to bite U.S. corporate profits from Ford and Harley-Davidson to Caterpillar and Walmart etc. U.S. corporate profit growth remains high a

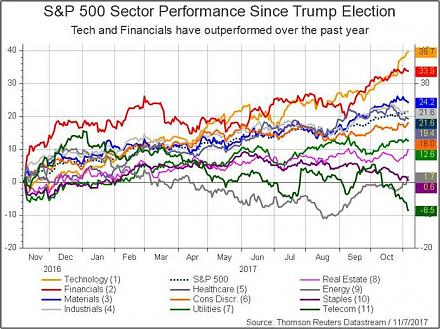

2017-10-09 09:34:00 Monday ET

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

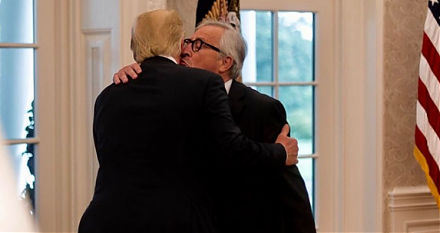

2018-07-23 07:41:00 Monday ET

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff