2018-02-23 09:35:00 Friday ET

Warren Buffett releases his annual letter to Berkshire Hathaway shareholders as of February 2018. Buffett discusses Berkshire's core cash ambition, its

2019-01-08 17:46:00 Tuesday ET

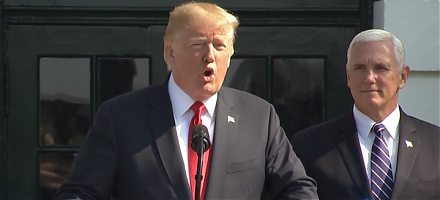

President Trump forces the Federal Reserve to normalize the current interest rate hike to signal its own monetary policy independence from the White House.

2019-09-05 09:26:00 Thursday ET

Yale macro economist Stephen Roach draws 3 major conclusions with respect to the Chinese long-run view of the current tech trade conflict with America. Firs

2019-10-13 16:22:00 Sunday ET

Apple unveils 3 iPhone 11 models with new original video services and stars such as Oprah Winfrey, Jennifer Aniston, and Reese Witherspoon. Apple releases t

2018-07-25 11:41:00 Wednesday ET

President Trump hails and touts America's new high real GDP economic growth in 2018Q2. The U.S. is now a $20+ trillion economy, and America hits this mi

2018-12-07 11:35:00 Friday ET

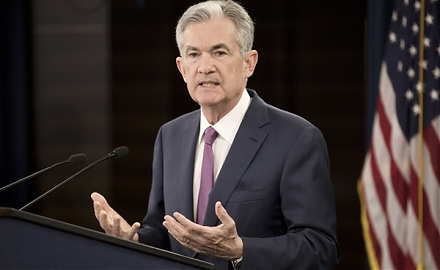

Fed Chair Jerome Powell hints slower interest rate increases because the current rate is just below the neutral threshold. NYSE and NASDAQ share prices rebo