2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2019-05-07 09:30:00 Tuesday ET

The Trump team receives a 3.2% first-quarter GDP boost as Fed Chair Jay Powell halts the next interest rate hike in early-May 2019. This smooth upward econo

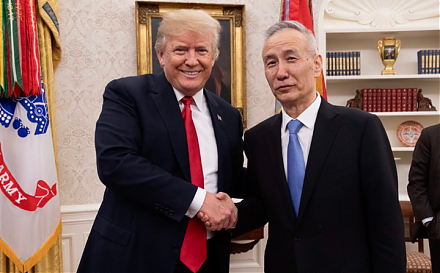

2018-12-09 08:44:00 Sunday ET

President Trump meets with Chinese President Xi again at the G20 summit in the city of Buenos Aires, Argentina, in late-November 2018. President Donald Trum

2017-11-23 10:42:00 Thursday ET

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins