2017-08-25 13:36:00 Friday ET

The U.S. Treasury's June 2017 grand proposal for financial deregulation aims to remove several aspects of the Dodd-Frank Act 2010 such as annual macro s

2018-10-27 09:34:00 Saturday ET

U.S. automobile and real estate sales decline despite higher consumer confidence and low unemployment as of October 2018. This slowdown arises from the curr

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J

2017-12-01 06:30:00 Friday ET

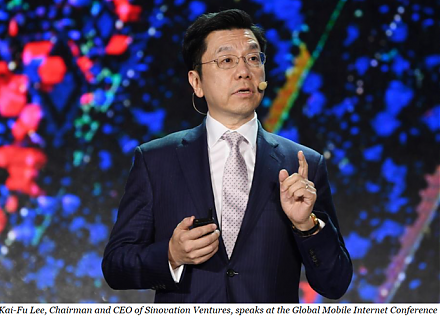

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2018-01-12 07:37:00 Friday ET

The Economist delves into the modern perils of tech titans such as Apple, Amazon, Facebook, and Google. These key tech titans often receive plaudits for mak

2020-10-27 07:43:00 Tuesday ET

Most agile lean enterprises often choose to cut costs strategically to make their respective business models fit for growth. Vinay Couto, John Plansky,