2019-08-26 11:30:00 Monday ET

Partisanship matters more than the socioeconomic influence of the rich and elite interest groups. This new trend emerges from the recent empirical analysis

2020-06-17 09:23:00 Wednesday ET

Successful founders focus on their continuous growth, passion, perseverance, and the collective wisdom of most team members. William Ferguson (2013) &

2018-05-13 08:33:00 Sunday ET

Incoming New York Fed President John Williams suggests that it is about time to end forward guidance in order to stop holding the financial market's han

2017-11-13 07:42:00 Monday ET

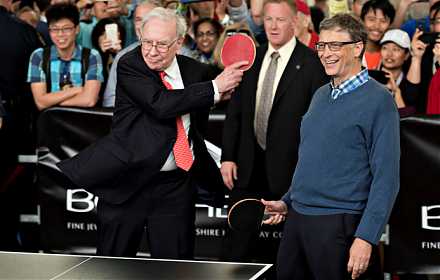

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2018-05-02 06:32:00 Wednesday ET

What are the primary pros and cons of free trade or fair trade in the current Sino-American quagmire? Free trade means allowing goods and services to move a

2023-08-28 08:26:00 Monday ET

Jared Diamond delves into how some societies fail, succeed, and revive in global human history. Jared Diamond (2004) Collapse: how societies