2023-06-28 09:29:00 Wednesday ET

Carmen Reinhart and Kenneth Rogoff delve into several centuries of cross-country crisis data to find the key root causes of financial crises for asset marke

2018-04-26 07:37:00 Thursday ET

Credit supply growth drives business cycle fluctuations and often sows the seeds of their own subsequent destruction. The global financial crisis from 2008

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2018-01-04 07:36:00 Thursday ET

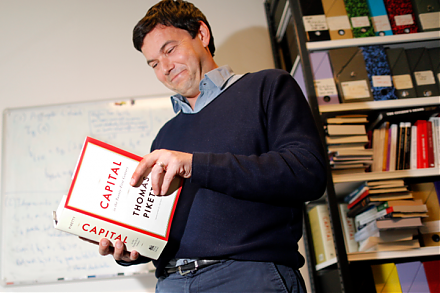

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2019-12-25 19:46:00 Wednesday ET

Former White House chief economic advisor Nouriel Roubini discusses the major limits of central-bank-driven fiscal deficits. The International Monetary Fund

2019-10-05 07:27:00 Saturday ET

Treasury Secretary Steven Mnuchin indicates that there is a good conceptual trade agreement between China and the U.S. in regard to intellectual property pr