2019-01-23 11:32:00 Wednesday ET

Higher public debt levels, global interest rate hikes, and subpar Chinese economic growth rates are the major risks to the world economy from 2019 to 2020.

2019-12-04 14:35:00 Wednesday ET

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an

2025-07-26 09:26:00 Saturday ET

Nir Eyal and Ryan Hoover explain why keystone habits lead us to purchase products, goods, and services in our lives. The Hooked Model can help shine new lig

2018-06-05 07:36:00 Tuesday ET

Just Capital issues a new report in support of the stakeholder value proposition in recent times. U.S. corporations that perform best on key priorities such

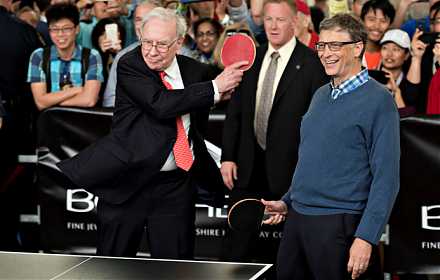

2017-11-13 07:42:00 Monday ET

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2018-05-03 07:34:00 Thursday ET

Sprint and T-Mobile propose a major merger in order to better compete with AT&T and Verizon. This mega merger is worth $26.5 billion and involves an all