2018-09-09 13:42:00 Sunday ET

Warren Buffett shares his key insights into life, success, money, and interpersonal communication. Institutional money managers and retail investors ca

2018-02-27 09:35:00 Tuesday ET

Fed's new chairman Jerome Powell testifies before Congress for the first time. He vows to prevent price instability for U.S. consumers, firms, and finan

2019-01-25 13:34:00 Friday ET

Netflix raises its prices by 13% to 18% for U.S. subscribers. The immediate stock market price soars 6.5% as a result of this upward price adjustment. The b

2017-05-31 06:36:00 Wednesday ET

The Federal Reserve rubber-stamps the positive conclusion that all of the 34 major banks pass their annual CCAR macro stress tests for the first time since

2018-06-08 13:35:00 Friday ET

The Federal Reserve delivers a second interest rate hike to 1.75%-2% and then expects subsequent rate increases in September and December 2018 to dampen inf

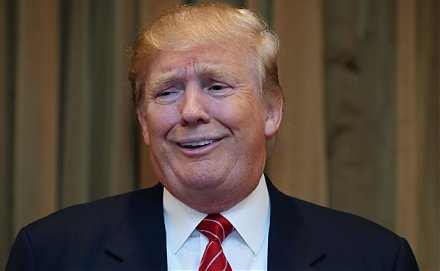

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta