Home > Library > AYA macro ebook on the fundamental analysis of the global financial system March 2025

Author Dan Rochefort

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Summer-Fall 2025, we delve into the fundamental analysis of core competitive advantages in the global financial system. In this fundamental analysis, the key actors include banks, insurers, and other non-bank financial intermediaries. We explain why and how financial technology effectively helps broaden the current scope of financial services worldwide, especially in a new cashless modern society. Through this analysis, we focus on the 5 primary pillars of financial stability policy: capital requirements, liquidity constraints, leverage limits, macro-prudential stress tests, and deposit insurance coverage rules.

Description:

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Summer-Fall 2025, we delve into the fundamental analysis of core competitive advantages in the global financial system. In this fundamental analysis, the key actors include banks, insurers, and other non-bank financial intermediaries. We explain why and how financial technology effectively helps broaden the current scope of financial services worldwide, especially in a new cashless modern society. Through this analysis, we focus on the 5 primary pillars of financial stability policy: capital requirements, liquidity constraints, leverage limits, macro-prudential stress tests, and deposit insurance coverage rules.

We delve into the mainstream public policy implications of financial deglobalization in recent years. The U.S. and its western allies impose some economic sanctions on global trade and finance in relation to China, Russia, Iran, and North Korea. In addition to these sanctions, hefty tariffs, embargoes, and foreign investment bans and restrictions further limit the macrofinancial clout of these countries. As the U.S. and its western allies cut off favorable trade relations with China, Russia, Iran, and North Korea, the current Russia-Ukraine war, the potential invasion of Taiwan by China, the relentless conflict between Israel and Hamas and the Palestinians, and several other geopolitical tensions exacerbate recent asset market fragmentation in the broader context of financial deglobalization. Even though the American dollar remains the dominant global reserve currency and global supply chains prove to be more resilient, global capital flows start to fragment in different directions in the particular context of financial deglobalization. The postwar world order of free trade continues to fall apart at a relatively slow and gradual pace.

The postwar global institutions that safeguard the old world order of free trade are either already defunct or deficient with a lack of longer-term credible commitments these days. The World Trade Organization (WTO) turns 30 in 2025, but continues to have spent more than 5 years in stasis due to western neglect. The World Bank seems to be caught between fighting world poverty and enriching the upper social echelon in new market economies with higher population dividends such as China, Brazil, India, Indonesia, and the Philippines. The International Monetary Fund (IMF) confronts its identity crisis and remains stuck in the middle between global financial stability and green finance in support of better climate risk management worldwide. The World Health Organization (WHO) now needs to cope with the post-pandemic public health risks and threats worldwide, such as new variants of the corona virus. In recent years, the U.N. security council fails to secure world peace and prosperity due to the Russia-Ukraine war in Eastern Europe, the relentless conflict between Israel and Iran, Hamas, and the Palestinians, as well as the recurrent flash points in the North Korean peninsula, Taiwan, South China Sea, and wider Pacific Ocean. The International Court of Justice attempts to weaponize the U.S. and its western allies by issuing arrest warrants for President Vladimir Putin and others who launch wars against humanity, but the Court has little jurisdiction over Russia and Ukraine in Eastern Europe, the Gaza Strip in Middle East, and the Pacific first island chain from the North Korean peninsula and Japan to Taiwan and the Philippines.

The resultant fragmentation of free markets in new democracies imposes a stealth tax on the global economy, in the form of higher inflation or lower purchasing power for each marginal dollar. Unfortunately, human history shows that deeper financial deglobalization may inadvertently worsen the current tilt toward secular stagnation worldwide. Today, a similar rupture seems all too imaginable. The return of Donald Trump to the White House, with his zero-sum worldview, would probably continue the gradual and recurrent erosion of global institutions, norms, and principles all in support of both free trade and democratic capitalism. The far-flung fear of a second wave of low-cost imports from China would likely accelerate this global trend. Any outright war between America and China over Taiwan, or between the NATO and Russia, would further cause an almighty collapse of the world trade system.

Nowadays, it is fashionable for economists to criticize free-market globalization as the root cause of social disparities in wealth and income worldwide, global financial imbalances, as well as climate change risks (even the increasingly hefty economic costs of rare extreme weather events). However, the free trade achievements from the 1990s to the early-2000s help mark the high point of liberal capitalism and then continue to be a rare, unique, and inimitable episode of human history. Through a free ride on the transition to new market economies, China, Brazil, India, Indonesia, and the Philippines integrated into the world economy. As a result, many hundreds of millions escaped poverty. Also, the current infant mortality rate worldwide is less than half what the rate was back in the 1990s, due to greater clean water and food. The proportion of global deaths due to inter-state wars and conflicts has hit a post-war low, less than a thousandth of 0.2% today, down from almost 40 times as high more than 50 years ago. Today, many leaders and politicians hope to replace the old Washington consensus on free trade and market capitalism. The Washington consensus depicts a world economy where poor countries enjoy capital spending booms to catch up on economic growth and employment with rich countries. Due to economic and non-economic risks and issues such as climate change, extreme weather, pandemic disease control, credit contagion, and nuclear proliferation etc, many leaders and politicians attempt to close the economic gap between rich and poor countries through alternative means of trade, finance, and technology.

Indeed, the postwar world order of free trade achieved a merry marriage between the U.S. peace principles and strategic interests. At the same time, this new liberal world order further brought real economic benefits to the rest of the world. In some parts of the world, however, poor residents continue to suffer from the World Bank and IMF’s inability to resolve the sovereign debt crisis after the Covid-19 pandemic years. Several middle-income countries such as India and Indonesia hope to trade their way to riches, but these countries end up trying to exploit free-trade loopholes and opportunities due to financial deglobalization and asset market fragmentation. In practice, the global economy should remain robust, resilient, and predictable in integrating most prior trade blocs and regions into the new world order of fair trade. In due course, the fair-trade integration helps ensure global peace and prosperity with the long prevalent American-driven institutions, norms, and principles in favor of free-market capitalism, democratization, and the lofty pursuit of a good life.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for U.S. stock market investors and traders. Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2018-07-27 10:35:00 Friday ET

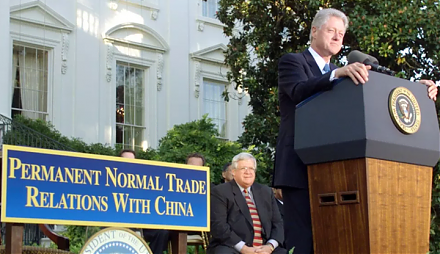

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th

2019-04-23 19:45:00 Tuesday ET

Income and wealth concentration follows the ebbs and flows of the business cycle in America. Economic inequality not only grows among people, but it also gr

2019-03-17 14:35:00 Sunday ET

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2017-12-23 10:40:00 Saturday ET

Despite having way more responsibility than anyone else, top business titans such as Warren Buffett, Charlie Munger, and Oprah Winfrey often step away from

2019-01-25 13:34:00 Friday ET

Netflix raises its prices by 13% to 18% for U.S. subscribers. The immediate stock market price soars 6.5% as a result of this upward price adjustment. The b

2025-05-21 04:27:10 Wednesday ET

Carol Dweck describes, discusses, and delves into the scientific reasons why the growth mindset often helps motivate individuals, teams, and managers to acc