Home > Library > AYA analytic report on global technological developments October 2024

Author Rose Prince

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Autumn-Winter 2024, this analytic report delves into the new global market for generative artificial intelligence (Gen AI). The mainstream Gen AI power engines apply large language models (LLM) and content generation tools to help enhance human lives with higher productivity. Productivity gains often manifest in the common forms of Gen AI-made scripts, articles, images, podcasts, films, and many other online contents. Gen AI avatars often help translate text, imagery, and sound recognition into interpretable contents within only seconds. This recent Gen AI hype transforms and even revolutionizes the high-tech stock market rally.

Description:

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Autumn-Winter 2024, this analytic report delves into the new global market for generative artificial intelligence (Gen AI). The mainstream Gen AI power engines apply large language models (LLM) and content generation tools to help enhance human lives with higher productivity. Productivity gains often manifest in the common forms of Gen AI-made scripts, articles, images, podcasts, films, and many other online contents. Gen AI avatars often help translate text, imagery, and sound recognition into interpretable contents within only seconds. This recent Gen AI hype transforms and even revolutionizes the high-tech stock market rally.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for U.S. stock market investors and traders. Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2019-12-10 09:30:00 Tuesday ET

Federal Reserve institutes the third interest rate cut with a rare pause signal. The Federal Open Market Committee (FOMC) reduces the benchmark interest rat

2018-09-11 18:36:00 Tuesday ET

President Trump tweets that Apple can avoid tariff consequences by shifting its primary supply chain from China to America. These Trump tariffs on another $

2017-01-27 17:19:00 Friday ET

Tony Robbins explains in his latest book on personal finance that *patience* is the top secret to successful stock investment. The stock market embeds an

2019-01-29 10:33:00 Tuesday ET

Global trade transforms from labor cost arbitrage to high-skill knowledge work. In fact, multinational manufacturers have been trying to create global suppl

2019-03-13 12:35:00 Wednesday ET

Uber seeks an IPO in close competition with its rideshare rival Lyft and other tech firms such as Slack, Pinterest, and Palantir. Uber expects to complete o

2019-08-31 14:39:00 Saturday ET

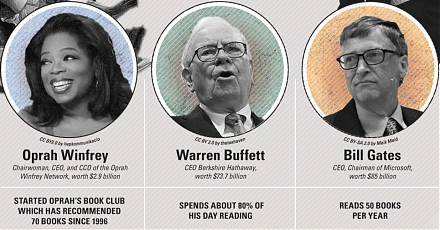

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B