Home > Library > AYA analytic report on macro-financial policy developments January 2026

Author Amy Hamilton

Our fintech finbuzz analytic report shines light on the current global macro-financial outlook. As of Winter-Spring 2026, we delve into the core lessons, rules, and new challenges from the recent monetary policy framework reviews worldwide. Several central banks that conduct their monetary policy framework reviews in recent years include the American Federal Reserve System, European Central Bank, Bank of England, and Bank of Japan. The Global Financial Crisis of 2008-2009, the Covid-19 pandemic crisis, inflation, and the output gap remain the central elements of the recent monetary policy framework reviews worldwide. The mainstream monetary policy frameworks include clear policy targets for inflation, nominal GDP, the price level, and so forth.

Description:

As of Winter-Spring 2026, we delve into the core lessons, rules, and new challenges from the recent monetary policy framework reviews worldwide. Several central banks that conduct their monetary policy framework reviews in recent years include the American Federal Reserve System, European Central Bank, Bank of England, and Bank of Japan. The Global Financial Crisis of 2008-2009, the Covid-19 pandemic crisis, inflation, and the output gap remain the central elements of the recent monetary policy framework reviews worldwide. The mainstream monetary policy frameworks include clear policy targets for inflation, nominal GDP, the price level, and so forth.

We delve into the mainstream rules, lessons, and fresh challenges from the recent monetary policy framework reviews worldwide. Several central banks that conduct their own monetary policy framework reviews in recent years include the American Federal Reserve System, European Central Bank, Bank of England, Reserve Bank of Australia, Reserve Bank of New Zealand, Bank of Japan, and so on. The Global Financial Crisis of 2008-2009, the Covid-19 pandemic crisis of 2020-2022, inflation, output growth, and macro-financial stability continue to be the central elements of the recent monetary policy framework reviews. The long prevalent, pervasive, and mainstream monetary policy frameworks often span clear and simple policy targets for inflation, nominal GDP, the price level, and credit control in some asset markets such as the global financial markets for stocks and bonds as well as the residential real estate market. In addition to these mainstream macro policy goals, climate risk management, residential property affordability, productivity growth, macrofinancial stability, and technological advancement now arise as novel elements of the macro mandate for some central banks.

Since 2000, several extraordinary events have severely tested the modern conduct of monetary policy worldwide. The U.S. subprime mortgage crisis, Global Financial Crisis of 2008-2009 and subsequent European sovereign debt debacle shattered the deceptive tranquility of the Great Moderation, the decades-long phase of lower output and inflation volatility in many rich economies through the 1980s and 1990s. In the subsequent decade, central banks struggled to push inflation back to the 2% target, or the broader target range of 1% to 3%. Like a bolt from the blue, the Covid-19 pandemic crisis caused widespread financial system stress. As a result, several economies plunged into a severe macro recession. From the Russia-Ukraine war in Eastern Europe to the conflicts between Israel and Iran, Lebanon, Hamas, and the Palestinians in the Middle East, these rare geopolitical events led to the largest, most pervasive, and most persistent inflationary outbreak in half a century. On both sides of the Atlantic Ocean, several banks experienced credit constraints, strains, and failures due to short-term severe shortages of liquid assets.

Many central banks have risen to this challenge. Their forceful responses to macro financial stress helped stabilized the global financial system with new quantitative-easing (QE) large-scale asset purchases, negative interest rates, macro-prudential stress tests, less lenient and more rigorous Basel liquidity and capital requirements, and additional leverage limits and deposit insurance rules for banks, insurers, and other non-bank financial institutions. In due course, these macro-financial policies helped constrain collateral damage to the global real economy. In response to the recent interest rate hikes, inflation continued to return to the broader target range of 1% to 3%, or the baseline 2% target, in rich countries and global capital markets. In these recent years, global supply chains and labor markets turned out to be both robust and resilient as the real economy navigated through rare geopolitical events, wars, conflicts, bank failures, and rampant Covid infections.

These recent extraordinary events have left a deep imprint on the modern conduct of monetary policy worldwide. Even before the Covid pandemic crisis of 2020-2022, nominal monetary policy interest rates had reached historical troughs near the zero lower bound. In some parts of the world, especially Europe and Japan, the interest rates hovered in the negative territory. In some rich countries, central bank balance sheets have expanded to historical peaks. In recent years, public debt remains on a worrisome trajectory worldwide. Many governments continue to feel fiscal strains on different aspects of their respective budgets. In light of non-market forces such as climate change, policy uncertainty, deglobalization, longer longevity, and green energy transformation, several structural forces continue to further complicate the modern conduct of monetary policy worldwide.

We broadly classify the modern conduct of monetary policy worldwide into 2 major phases: (1) the Global Financial Crisis of 2008-2009 and its aftermath, and (2) the global pandemic outbreak of Covid-19 and its subsequent market consequences. These rare disasters dramatically reshaped monetary policy responses around the world. In effect, the Global Financial Crisis marked the end of the Great Moderation, the decades-long period of remarkable macroeconomic stability with lower inflation and relatively high and stable output growth in many parts and regions of the world. Under the calm surface of low inflation and steady output growth, however, macro-financial market vulnerabilities continued to build up in core residential real estate and mortgage credit markets. At the same time, private credit expansion continued through the major asset price booms. Low interest rates reinforced this pervasive private credit expansion, as many central banks chose to ease the monetary policy stance in response to the American dotcom stock market crash and the September 11 terrorist attack in 2001. After the unsustainable credit expansion and asset price boom worldwide, the Global Financial Crisis of 2008-2009 plunged many markets into the deepest recession since the Great Depression of the 1930s. Specifically, the American investment bank, Lehman Brothers filed for bankruptcy in September 2008. Some other banks, AIG and Bear Stearns, experienced financial difficulties too. Many financial institutions teetered on the verge of insolvency, vast segments of money markets froze, and global asset prices plummeted as a result.

Key central banks responded forcefully to the Global Financial Crisis of 2008-2009. Many central banks reduced monetary policy interest rates aggressively to the zero lower bound. Also, these central banks expanded their balance sheets significantly through large-scale asset purchases to provide liquidity support to banks, insurers, and other non-bank financial institutions worldwide. In the early phase of the Global Financial Crisis, these central banks played their respective roles of lenders of last resort. In this capacity, these central banks drew on government solvency support. As a result, the initial expansion of central bank balance sheets took the main form of government loans to financial institutions. Some central banks further continued their QE large-scale asset purchases to ease macro-financial stress conditions. As a consequence, their balance sheets expanded further with long-term government bonds and mortgage securities. In effect, these near-term QE efforts leveraged the extant bank reserves, capital requirements, and liquidity buffers.

In the next few years from 2010 to 2018, we saw a shallow economic recovery and persistent inflation shortfalls from the respective target ranges worldwide. Several central banks faced fresh concerns about deflation. These central banks engaged in forceful coordination to ease monetary conditions in the major rich countries. In effect, these central banks chose to build on the same QE monetary policy toolkit that they had deployed to contain the Global Financial Crisis. These central banks sought to ease financial stress conditions well beyond the short-term interest rates. Specifically, central banks substantially reduced their respective policy rates to the zero lower bound. In the special cases of European Union and Japan, their central banks further reduced their respective policy rates into negative territory. Several central banks resorted to forward guidance to signal the medium-term commitment to keeping lower interest rates for longer. With widespread fiscal-monetary policy coordination, central banks further expanded their QE large-scale asset purchases. In turn, these QE asset purchases sometimes included private-sector assets such as corporate bonds and stock market ETFs.

In the subsequent years from late-2019 to mid-2023, the Covid-19 pandemic crisis abruptly ended an incipient monetary policy normalization worldwide. As the global economy hit hibernation to forestall a public health catastrophe, a deep economic contraction put global macro-financial stability at risk again. In response to the new corona virus crisis, central banks reduced short-term interest rates substantially to the zero lower bound and then launched new balance sheet measures. This time was no different. Central banks combined emergency liquidity injections with bank-specific subsidies in the form of QE bond purchases. In light of these QE measures, central bank balance sheets surged to new historical highs.

Central banks substantially expanded their respective balance sheets through QE large-scale asset purchases in the 15-year episode from 2008 to 2023. Specifically, the American Federal Reserve System substantially boosted the size of its balance sheet to more than $8 trillion. Also, the European Central Bank raised its QE asset purchases to more than $6 trillion. In addition, the Bank of Japan increased its own balance sheet to more than $4 trillion over the same time frame, while the Bank of England expanded its own balance sheet to almost $1 trillion. As rare geopolitical events and other rare disasters happen more often, we believe central banks tend to include QE large-scale asset purchases as part of their respective conventional monetary policy toolkits in the next few decades.

As the global economy gradually recovered from the Covid pandemic crisis, central banks faced new inflationary pressures worldwide. Inflation was almost always and everywhere a monetary phenomenon. In many countries, inflation rose to double-digits. Global supply chains had failed to respond elastically to new fiscal-monetary coordination worldwide in response to the Covid pandemic crisis. Although the real economy eventually recovered from the public health crisis, this recovery led to the rotation of macro demand from services to goods. As a result, this rotation caused steep commodity price hikes in the subsequent Russian invasion of Ukraine. The Russia-Ukraine war further fueled the inflationary price hikes, especially for oil and natural gas resources in Eastern Europe.

In response to new inflationary price pressures, many central banks raised short-term interest rates in both real and nominal terms. After these serious interest rate hikes, several central banks began to dramatically shrink their respective balance sheets via quantitative tightening (QT) large-scale asset sales. Through such near-term macro episodes, these central banks had to cope with fast and furious swings in capital flows and exchange rates from the recent economic developments in the Russia-Ukraine war in Eastern Europe and the relentless conflicts between Israel and Iran, Lebanon, Hamas, and the Palestinians in the Middle East. In recent years, inflation gradually declined toward the 2% target or the broader target range of 1% to 3%. In the vast majority of small open economies, central banks weathered fresh inflationary challenges by relying on broad monetary policy frameworks, rules, and principles. The extant monetary policy frameworks, rules, and principles combined some simple single inflation targets, or broader inflation target ranges, with flexible foreign exchange intervention, macro-financial market stabilization for climate risk management, and active macro-prudential credit control for better residential real estate affordability worldwide.

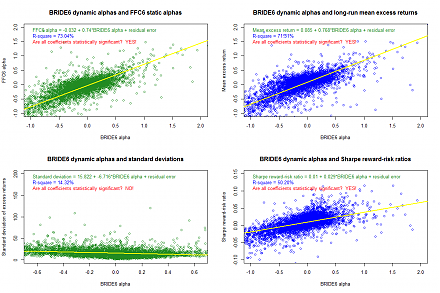

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for U.S. stock market investors and traders. Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2019-03-23 09:31:00 Saturday ET

Congresswoman Alexandria Ocasio-Cortez proposes greater public debt finance with minimal tax increases for the Green New Deal. In accordance with the modern

2017-12-14 12:41:00 Thursday ET

Federal Reserve raises the interest rate by 25 basis points to the target range of 1.25% to 1.5% as FOMC members revise up their GDP estimate from 2% to 2.5

2018-08-15 14:40:00 Wednesday ET

Senator Elizabeth Warren advocates the alternative view that most U.S. trade deals serve corporate interests over workers, customers, and suppliers etc. She

2019-12-10 09:30:00 Tuesday ET

Federal Reserve institutes the third interest rate cut with a rare pause signal. The Federal Open Market Committee (FOMC) reduces the benchmark interest rat

2023-06-28 09:29:00 Wednesday ET

Carmen Reinhart and Kenneth Rogoff delve into several centuries of cross-country crisis data to find the key root causes of financial crises for asset marke