Home > Library > Global history of macroeconomic thought

Author Andy Yeh Alpha

Our fintech finbuzz analytic ebook sheds new light on the fundamental themes and insights in the modern economic science from 2000 to 2022. As of Spring-Summer 2022, this ebook provides fresh insights into the mainstream schools of economic thoughts from the neoclassical synthesis and monetarism to the New Keynesian framework and Keynesian search theory. Furthermore, this ebook focuses on the competitive advantages, opportunities, risks, and threats etc of both tech titans and megabanks in the modern age of digital tech proliferation. Fresh opportunities arise in the broader context of Internet search, consumer technology, e-communication, social media, software, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of both tech titans and banks as several regulatory institutions mistrust these corporations in global economic history.

Description:

Our fintech finbuzz analytic ebook sheds new light on the fundamental themes and insights in the modern economic science from 2000 to 2022. As of Spring-Summer 2022, this ebook provides fresh insights into the mainstream schools of economic thoughts from the neoclassical synthesis and monetarism to the New Keynesian framework and Keynesian search theory. Furthermore, this ebook focuses on the competitive advantages, opportunities, risks, and threats etc of both tech titans and megabanks in the modern age of digital tech proliferation. Fresh opportunities arise in the broader context of Internet search, consumer technology, e-communication, social media, software, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of both tech titans and banks as several regulatory institutions mistrust these corporations in global economic history.

This analytic ebook cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This ebook shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2018-08-27 09:35:00 Monday ET

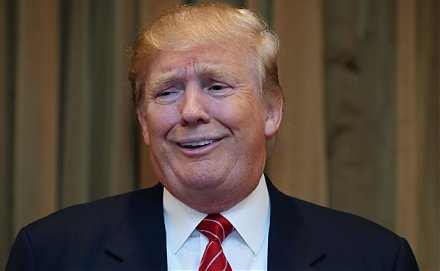

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2017-11-23 10:42:00 Thursday ET

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2018-06-17 10:35:00 Sunday ET

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow th

2018-11-29 11:33:00 Thursday ET

A congressional division between Democrats and Republicans can cause ripple effects on Trump economic reforms. As Democrats have successfully flipped the Ho

2018-08-09 16:36:00 Thursday ET

President Trump applies an increasingly bellicose stance toward the Iranian leader Hassan Rouhani as he rejects a global agreement to curb Iran's nuclea

2018-11-05 10:40:00 Monday ET

Former Fed Chair Janet Yellen worries about U.S. government debt accumulation, expects new interest rate increases, and warns of the next economic recession