Home > Library > AYA analytic report on the top tech titans (FAMGA) November 2020

Author James Campbell

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.M.G.A.). As of Autumn-Winter 2020, this report focuses on the competitive advantages, opportunities, and threats for F.A.M.G.A. in the modern age of digital tech diffusion. Key opportunities arise in the broad context of social media, consumer technology, software, Internet search, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of F.A.M.G.A. as many U.S. institutions mistrust tech titans in American history. Our fundamental analysis focuses on the key actionable insights and metrics for the corporate performance and stock valuation of each tech titan. The recent rampant corona virus crisis worsens economic inequality due to smart automation and artificial intelligence.

Description:

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.M.G.A.). As of Autumn-Winter 2020, this report focuses on the competitive advantages, opportunities, and threats for F.A.M.G.A. in the modern age of digital tech diffusion. Key opportunities arise in the broad context of social media, consumer technology, software, Internet search, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of F.A.M.G.A. as many U.S. institutions mistrust tech titans in American history. Our fundamental analysis focuses on the key actionable insights and metrics for the corporate performance and stock valuation of each tech titan. The recent rampant corona virus crisis worsens economic inequality due to smart automation and artificial intelligence.

Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2018-11-11 13:42:00 Sunday ET

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears

2018-06-04 08:38:00 Monday ET

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t

2018-10-19 13:37:00 Friday ET

PayPal earns great fintech reputation from its massive worldwide network of 250+ million active users. As PayPal beats the revenue and profit expectations o

2020-07-26 15:29:00 Sunday ET

Firms and customers create value and wealth together by joining the continual flow of small batches of lean production to the lean consumption of cost-effec

2018-07-23 07:41:00 Monday ET

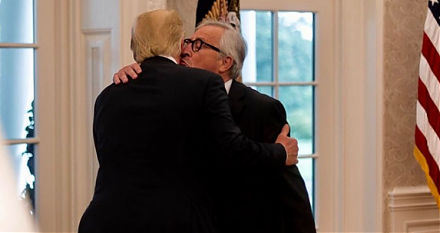

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff