Home > Library > An empirical implementation of CreditGrades

Author Andy Yeh Alpha

This research article empirically implements the novel and non-obvious credit risk model CreditGrades.

Description:

We use the CreditGrades credit risk model to value credit default swap (CDS) spreads for public companies at the intersection of the S&P 100 index and Moody's Bottom Rung report for the global financial crisis period from 2007Q3 to 2009Q2. We implement this canonical credit risk model in accordance with the *CreditGrades technical document* jointly developed by Goldman Sachs, JP Morgan, Deutsche Bank, and RiskMetrics. Our empirical study focuses on the strengths and weaknesses of the chosen risk model by analyzing the main empirical results with several complementary statistical and qualitative tests for better triangulation.

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins

2020-09-24 10:26:00 Thursday ET

Edge strategies help business leaders improve core products and services in a more cost-effective and less risky way. Alan Lewis and Dan McKone (2016)

2017-12-01 06:30:00 Friday ET

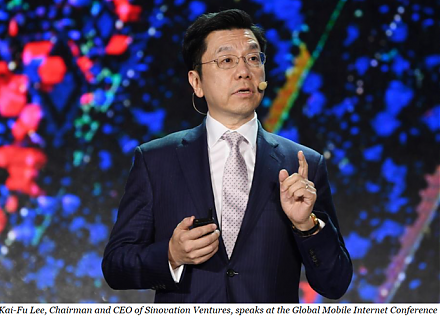

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2018-05-06 07:30:00 Sunday ET

President Trump withdraws America from the Iran nuclear agreement and revives economic sanctions on Iran for better negotiations as western allies Britain,

2018-10-15 09:33:00 Monday ET

Several pharmaceutical companies now switch their primary focus from generic prescription drugs to medical specialties such as cardiovascular medications an

2018-04-11 09:37:00 Wednesday ET

North Korean leader and president Kim Jong-Un seeks peaceful resolution and denuclearization on the Korean Peninsula. When *peace* comes to shove, Asia